A Tale of Two Tech Sectors: Why Submarkets Matters When Defining Your Sales Cycle

As the majority of B2B buyers rejoice in the normalization of remote selling, businesses around the world have been working diligently to meet the demands of the new environment.

Before it was mainstream, we at Martal Group had been helping companies generate leads virtually with sales representatives trained in the art of long-distance prospecting.

The insight we have gained in the tech industry specifically has prepared us to keep our clients thriving despite the hardships of the recent pandemic. However, those switching to a more remote customer acquisition approach have experienced varying results.

Interestingly enough, we have seen through our data that the discrepancies are dependent on the sector of the tech industry with which these companies operate in. Let’s take a look at two popular submarkets Martal Group has served over the past few years to determine why these challenges in lead generation arise and what can be done to improve success rates.

Outsourced Software Development

The Hurdle

The low supply and high turnover of software engineers have companies understaffed and over budget in their IT departments. Many of our clients have amazing solutions, such as outstaffing and custom software development, to help businesses overcome these challenges. But while the concept of outsourcing is not new by any means it can be hard to win over the skeptics that prefer an in-house approach to software development. For this reason, we often see fewer responses and longer sales cycles in the first 90 days of campaigning.

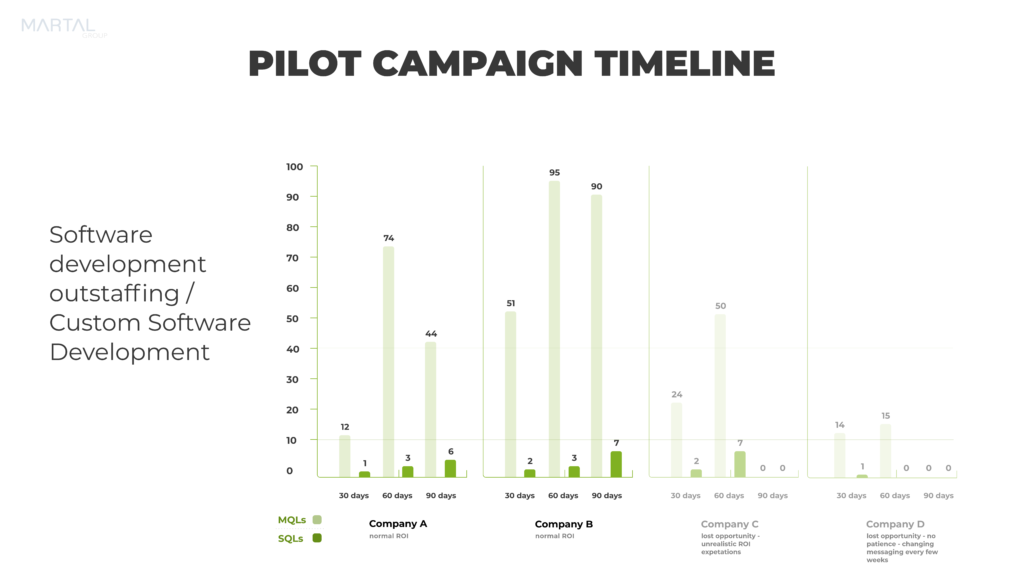

Let’s take a look at four different companies in the software development outsourcing sector that experienced two different outcomes:

Company A and Company B

You can see from the chart that Company A and B had a quick start, and we were able to triple both companies’ sales-qualified leads (SQLs) at the 60-day mark with an average of almost one per week. By 90 days, Company A and B had received six and seven SQLs, respectively.

At a glance, the performance may seem lackluster. But after over a decade of exclusively serving the B2B tech industry, we have found that achieving one to two SQLs in the first month of campaigning is typical for the outsourced software development submarket.

While these numbers should be expected, it’s no less concerning for business leaders ready to make progress now. What’s important to remember in the early stages of outbound lead generation is pushing for change too early can actually cause further setbacks as we’ll see in our next example.

Company C and Company D

When we look at Company C and D we see similar results in the first 30 days with no more than two SQLs per campaign. The contrast in this comparison starts in the second month, but the causes for the stark differences go much deeper than the numbers in the chart.

While Company A and B patiently waited out the moderate progress and were rewarded with steady growth in the coming months, Company C and D were less accepting of the industry trends that we have seen time again with similar offers.

In particular, Company D made significant and frequent changes to messaging in an attempt to improve performance instead of opting for incremental adjustments as opportunities for optimization arose. This is much like initiating a factory data reset on your sales cycle. All the valuable data you collected is lost and all touchpoints to prospective clients are null and void requiring sales representatives to start from a blank slate. Looking at the company’s results in the second month, we can see that the reset took a toll on its ability to engage with qualified prospects.

Company C’s campaign, on the other hand, performed phenomenally with seven SQLs in month two, more than Company A and B combined compared to the same timeframe. Unfortunately, we can only assume the 90-day numbers for Company C. Although the campaign’s performance was exceeding our account averages for outsourced software development, Company C decided to discontinue further outreach.

What We Can Learn

The concept of outsourcing or even nearshoring software development is a bit abstract as the needs are different for every business. One company may simply want assistance with a specific piece of software development that no one on staff is trained to program. Another may be looking for a long-term solution that requires staff augmentation. Hitting on all of these different solutions in short, compelling messages can be challenging. You need multiple touchpoints, through multiple sales channels, with very precise and clean lead data to draw in the right prospects.

The worse thing you can do is stop your outreach after less than two months of campaigning because, as can be seen from Company A and B, your result will start to increase exponentially if you hold on just a little longer.

Cybersecurity Software

The Hurdle

Despite the spike in breaches, cybersecurity is another tough tech solution to sell. Fear tactics have been used so frequently that prospects are programmed to tune them out like a well-seasoned buyer blocking out a protection plan pitch.

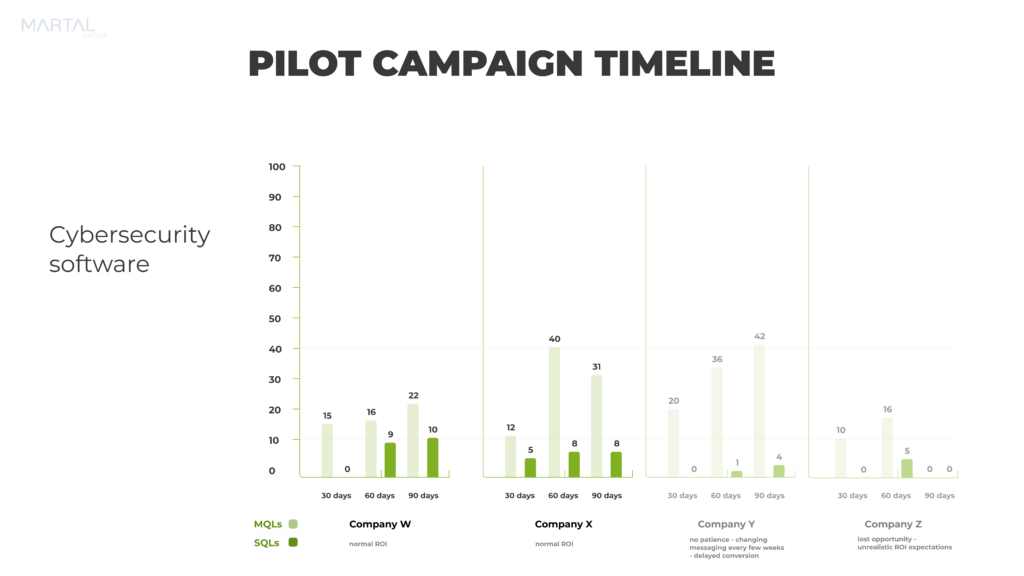

With every campaign we run for cybersecurity firms we have to build up more trust and rapport than we would any other SaaS solution. So again, we have a tech sector that has a longer sales cycle requiring more interactions through hyper-targeted and coordinated outreach:

Company W and Company X

By looking at our second chart we can see that Company X had a much better beginning than its peers. Landing five Sales Qualified Leads (SQLs) within the first 30 days is above average performance for not just cybersecurity but almost any B2B outbound sales campaign. Company W, on the other hand, reflects that of a typical cybersecurity sales trend.

Through the next 60 days of outreach, both companies averaged a minimum of two SQLs per week. At 90 days, Company W had a slight increase while Company X maintained the growth achieved in the previous month.

Company Y and Company Z

The last two companies, Y and Z, struggled to accept the lack of MQL = > SQL conversion that generally accompanies the first few weeks of most cybersecurity campaigns.

Like Company C in the outsourced software development example, Company Y changed the messaging too frequently, not allowing for the campaign to run its course which in turn delayed conversions. As Jean de Le Fountaine said, “A person often meets his destiny on the road he took to avoid it.” And so, instead of seeing a welcoming increase in SQLs for month two, like its patient peers, Company Y only opened one new opportunity over a 60-day period. By month three we were able to put the progress back on track and quadrupled Company Y’s sales opportunities.

In comparison, Company Z went from zero SQLs in the first month to five in the next, but similar to Company D, Company Z decided to cut the campaign short. You might be wondering why they would take such a stance. In light of what we have seen, the campaign for Company Z outperformed five out of the eight examples shown in this article. What we have found is that many business leaders, especially those that have worked in technology, find it hard to accept the variations in ramp-up time based on submarkets.

What We Can Learn

The importance of cybersecurity is often overshadowed by investments that promise a more immediate and definite return. In fact, 60% of small to medium-size businesses don’t see cybercrimes as a major threat. Ironically, out of the small businesses that do experience a cyberattack, 60% have to close up shop after six months.

Putting performance into perspective is important in outbound marketing. In comparison, cybersecurity tends to gain less traction in the first 30 days of campaigning than outsourced software development. By 60 days, however, not only are the majority of our cybersecurity clients receiving SQLs, but they are obtaining more opportunities than the average outsourced software development firm.

Conclusion

We have seen too many clients short-change their chances for success due to fear of failure. As a sales leader, I know how painful it can be to see seemingly stagnant performance week after week. However, the above demonstrates how building patience in your processes can pay off in the long run.