2026 B2B Customer Acquisition Cost Benchmarks (and How to Beat Them)

Major Takeaways: B2B Customer Acquisition Cost

A healthy B2B CAC is supported by an LTV:CAC ratio of at least 3:1. SaaS and services firms exceeding 4:1 signal scalable, efficient growth.

B2B customer acquisition cost has increased over 60% in the past five years due to rising ad prices, longer sales cycles, and greater competition.

Average customer acquisition cost in B2B ranges from $270 in SaaS to $1,400 in education tech. CAC is highest in high-touch, regulated industries.

Demand generation, sales outsourcing, and multi-channel outreach are proven to reduce customer acquisition costs while scaling revenue predictably.

Outsourced SDR teams and fractional sales experts help reduce CAC by increasing conversion rates and lowering the cost of each sales contact.

Companies using AI or intent signal tools report up to 93% better conversion rates, focusing acquisition spend on high-probability opportunities.

Improving win rates through sales training, messaging alignment, and qualification strategies boosts conversion and lowers CAC per closed deal.

Top-performing B2B teams review CAC monthly by channel to optimize spend, identify spikes, and shift budget toward efficient acquisition sources.

Introduction

B2B customer acquisition costs have skyrocketed by 60% in the past five years (3). If winning new clients feels more expensive than ever, you’re not alone. Rising digital ad prices, longer sales cycles, and fierce competition are driving up the cost to acquire customers across industries.

How can your company keep customer acquisition cost (CAC) under control in 2026? This in-depth guide will break down B2B customer acquisition cost benchmarks, explain how to calculate CAC (and why it matters), and share advanced strategies to reduce customer acquisition costs using modern tactics from demand generation to AI-driven outbound.

We’ll also compare average CAC by industry – from SaaS to services, SMB to enterprise – so you can see where you stand. Most importantly, you’ll learn practical ways to beat the benchmarks with smarter spending, sales outsourcing, and optimizations that lower your CAC without slowing growth. Let’s dive in.

What is Customer Acquisition Cost (CAC) in a B2B Business?

CAC has increased by over 60% in the past five years across B2B industries, driven by rising ad costs and longer sales cycles.

Reference Source: Genesys

Customer Acquisition Cost (CAC) is the total cost of winning a new customer – essentially, how much your sales and marketing spend to sign one account.

How do you calculate customer acquisition cost for B2B sales? It includes all expenses in the acquisition process: marketing campaigns, sales team salaries/commissions, software, content creation, travel for sales meetings, etc., divided by the number of new customers acquired in that period.

For example, if your B2B company spent $50,000 on marketing and sales last quarter and acquired 200 new customers, your average CAC was $250 per customer (i.e. $50,000 ÷ 200) (1).

Tracking CAC is crucial because it directly impacts profitability. In B2B, where deal cycles are longer and customer relationships often span years, CAC tells you if your growth is sustainable. A high CAC eats into your margins and means it takes longer to recoup the investment of acquiring each customer. A low CAC (relative to the revenue a customer brings in) means your sales machine is efficient and scalable. Simply put: CAC is a measure of how efficiently you turn budget into new business.

Why does CAC matter so much for B2B firms? First, B2B sales typically involve higher-touch processes – multiple sales calls, product demos, proposals, negotiations – which drive up costs. Second, B2B customer relationships tend to be long-term, so companies are willing to invest more upfront to win valuable accounts. Many B2B companies have seen acquisition costs climb steadily due to factors like digital ad saturation, buyer aversion to cold outreach, and increased competition for decision-makers’ attention. Monitoring CAC helps you ensure these rising costs don’t outpace the lifetime value of your customers.

CAC has increased ~60% over five years industry-wide (3), making it more important than ever to optimize how you acquire customers. Even if you’re growing revenue, failing to keep CAC in check can undermine profitability. In short, CAC is a vital KPI for CMOs, CROs, and sales leaders to watch. It quantifies the efficiency of your go-to-market strategy and reveals whether your sales & marketing engine is driving profitable growth or burning cash.

How to Calculate B2B Customer Acquisition Cost (CAC)

A 3:1 LTV to CAC ratio is the recommended benchmark for sustainable B2B customer acquisition.

Reference Source: Usermaven

Calculating CAC is straightforward in formula, but can be nuanced in practice. At its simplest:

CAC = (Total Sales & Marketing Costs) ÷ (Number of New Customers Acquired)

For a given period (month, quarter, year), add up all expenses related to acquiring customers – this includes marketing spend (campaigns, ads, content, events), sales team compensation (salaries, commissions, bonuses), sales software or services, and any other overhead tied to customer acquisition. Divide that sum by the number of new customers acquired in the same period (1). The result is your average cost per new customer acquired.

What to include: In B2B, don’t forget less obvious costs like the salary of your SDRs/BDRs, the travel and entertainment budget for your sales reps, fees for lead generation tools or agencies, and even the cost of trials or POCs if you offer those free to prospects. All these contribute to the true cost of acquiring a customer.

What is the difference between CAC and cost per lead (CPL) in B2B marketing?

It’s useful to distinguish Cost Per Lead (CPL) from CAC. CPL measures how much you spend to acquire a lead (someone who raises their hand or enters your funnel), often broken down by channel. CAC goes a step further – it measures cost per actual customer won. Naturally, CAC will be higher than CPL because not every lead converts to a paying customer. For instance, if your average CPL from LinkedIn Ads is $100 and 1 in 10 leads becomes a customer, the advertising portion of CAC for that channel would be $1,000. But CAC also factors in the sales effort to turn that lead into a client. High CPLs can signal expensive lead sources, but a low CPL with poor conversion can be just as costly. That’s why tracking the full CAC is vital – it accounts for marketing and sales efficiency.

LTV:CAC ratio: A key insight comes from comparing CAC to the Lifetime Value (LTV) of a customer.

What’s a healthy CAC to lifetime value (LTV) ratio for a B2B company?

In most industries, a healthy LTV:CAC ratio is around 3:1 or better (1). This means the revenue a customer generates over their lifetime (often measured as gross profit from that customer) is at least 3 times the cost to acquire them.

For example, if an average B2B customer is worth $30,000 in gross profit over 2 years, spending up to about $10,000 to acquire that customer (3:1 ratio) is considered acceptable. At 1:1 or 2:1, you’re likely losing money or barely breaking even on customer acquisition. At much above 4:1, you might actually be under-investing in growth opportunities (1) – in other words, leaving market share on the table by not spending enough to reach more customers. The 3:1 rule is a guiding benchmark: it ensures you balance growth with profitability. (Venture-backed SaaS startups might tolerate lower ratios for a time to grow faster, whereas established firms aim for higher to ensure profitability.)

Example: Say last year your company spent $5 million on sales and marketing and acquired 250 new B2B customers. Your average CAC was $20,000. If each of those customers has an average lifetime value of $80,000, then LTV:CAC = 4:1 – a strong ratio indicating efficient acquisition. If LTV was only $50,000, the ratio is 2.5:1 – a warning sign that customer acquisition cost is too high relative to value, and you either need to reduce CAC or improve LTV (through pricing, upsells, retention). Keep an eye on LTV:CAC alongside CAC itself, as it’s a powerful indicator of sustainability. Many investors and boards look at LTV:CAC to judge the health of a B2B business model.

CAC payback period: Another metric to consider is payback period – how many months of revenue it takes to recoup the CAC. For instance, if your CAC is $1,000 and a customer pays $500 per month, the CAC payback is 2 months. B2B companies aiming for efficient growth often target a payback period of 12 months or less (especially in SaaS). This ensures you’re not burning cash for too long before a customer becomes profitable.

Calculating CAC accurately requires good data. Make sure your CRM and accounting capture marketing spend and sales costs, and attribute new customer counts in the same timeframe. It can get tricky when you have long sales cycles (did that customer closed this quarter actually originate from last year’s leads?). Many teams use reporting tools or analytics platforms to track CAC by month and by channel. The effort is worth it – knowing your CAC is the first step to managing it proactively.

Average Customer Acquisition Cost B2B Benchmarks by Industry (2026 Outlook)

The average CAC in B2B SaaS is $270–$300, while Education and Legal Services can exceed $1,000 per customer.

Reference Source: Usermaven

How much should a new customer cost in your industry? Benchmarking your average customer acquisition cost against peers can put your numbers in context. In 2026, CAC figures vary widely by industry, business model, and customer segment. Below we highlight B2B CAC benchmarks for key sectors, based on recent research and a 2026 outlook. Use these as directional benchmarks – actuals will differ by company size and model – but they illustrate how CAC stacks up across industries.

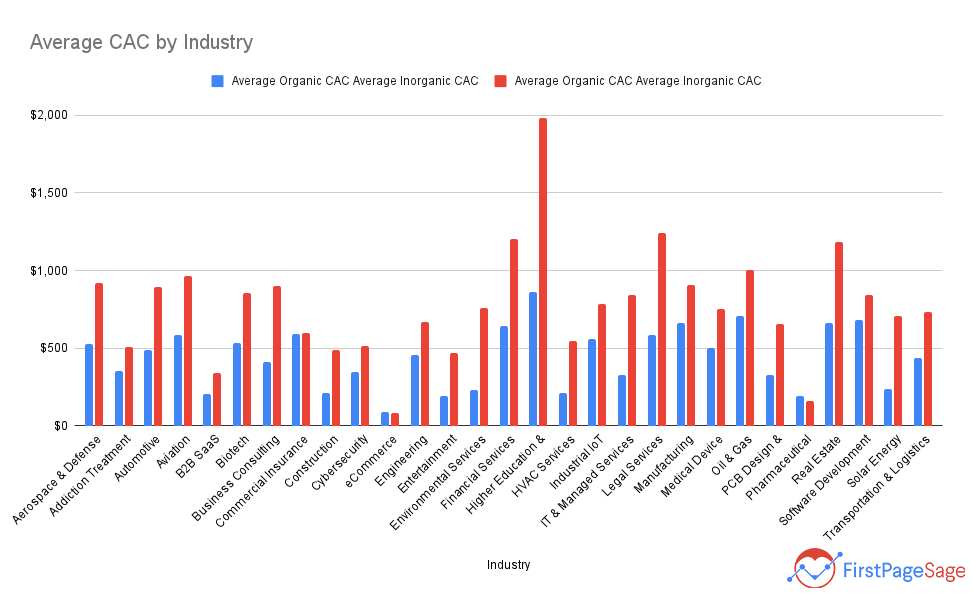

Source: FirstPageSage

As the above chart shows, B2B customer acquisition costs are significantly higher in certain industries. For example, B2B startups in Higher Education average around $1,400 CAC per customer, one of the priciest segments. This makes sense – selling to universities and colleges involves long sales cycles, committee decision-making, and often on-site visits, all of which drive up costs. In Financial Services, B2B customer acquisition averages roughly $900 (for smaller firms) up to $4,000 for large wealth management providers (3). Highly regulated fields like Finance or Medtech see elevated CAC because of trust-building and compliance hurdles; however, their customer lifetimes and deal sizes are also large, which can justify the cost.

By contrast, B2B SaaS companies enjoy some of the lowest CAC among B2B firms – roughly $200–$300 on average to acquire a customer in 2026 (1). SaaS products (especially with product-led growth or free trials) can acquire customers more cheaply at scale, particularly when targeting SMBs or using viral distribution. Note that enterprise-focused SaaS will have higher CAC than a self-service SaaS product; CAC in SaaS can range from under $300 into the thousands for complex enterprise software (1). Enterprise vs. SMB is a major factor: selling to enterprise clients often requires a field sales team, lengthy pilots, and RFP processes – CAC might be 5–10x higher than selling a simpler SaaS tool to small businesses. The flip side is enterprise clients usually have much larger contracts (higher LTV), so a high CAC can still be worthwhile. Meanwhile, SMB-focused offerings often rely on lower-cost inbound channels and inside sales, keeping CAC lower.

Let’s look at a few benchmark CAC figures for B2B (average combined marketing + sales cost per customer):

- Higher Education (B2B EdTech or services): ~$1,400 CAC per customer (1). (By contrast, a B2C education app might spend under $120 per user.)

- Legal Services (B2B law firms or legal tech): ~$900–$950 CAC (1).

- Financial Services (B2B fintech, financial software): ~$900+ CAC (1) for smaller deals, with enterprise financial SaaS often >$1k.

- Commercial Insurance: ~$590 CAC (1).

- Manufacturing (B2B industrial products): ~$784 CAC.

- IT & Managed Services: ~$583 CAC.

- Business Consulting: ~$656 CAC (1) (project-based consultancies have moderate marketing costs but often high sales pursuit costs).

- B2B SaaS: ~$270–$300 CAC (1) on average. (Notably one of the lowest, thanks to scalable distribution and often inside sales. Within SaaS, Fintech SaaS can be much higher, ~$1,450, whereas eCommerce SaaS or Legaltech might be ~$250–$300 (1).)

In general, B2B CAC is higher than B2C CAC in similar categories. Why? B2B buyers take more convincing – multiple stakeholders, higher price points, and longer decision processes drive up the cost per acquisition. Meanwhile, B2C companies benefit from impulse purchases and mass marketing. For example, an e-commerce retail brand might have a CAC around $80 (1), whereas a B2B product in a similar space (say a wholesale supplier platform) could be several hundred dollars. Even within tech: a B2C streaming service or app might acquire users for tens of dollars or less, while a B2B software firm spends hundreds.

It’s also useful to compare CAC by marketing channel as part of benchmarks. Industry data shows some channels are far more cost-efficient than others for B2B:

- Email marketing and organic SEO are often the lowest-cost channels on a cost-per-lead basis. Email, in particular, delivers a strong ROI with some of the lowest CPL figures across digital channels (3). If you build a qualified email list or nurture leads effectively, the incremental cost to reach them is low.

- Content marketing (blogging, SEO, webinars) yields compounding results. While it takes upfront investment, inbound content leads cost 61% less on average than leads from outbound methods (10). (Research found inbound marketing drastically cheaper per lead than traditional outbound.) In B2B, this means educational content and thought leadership can bring in leads at a fraction of the cost of paid ads.

- Paid search advertising (SEM) in B2B can be pricey – one report noted B2B paid search CAC around $800 on average (especially for high-value software keywords) (3). High competition on keywords and lower conversion rates on expensive offerings drive this up.

- Trade shows and events are typically the most expensive lead sources. When factoring travel, sponsorships, and time, events can have an eye-popping CPL/CAC. For instance, in-person trade shows average about $811 per lead – the highest of any channel (3). That doesn’t mean they aren’t valuable (they also serve branding and partnership goals), but purely for acquisition cost, they’re pricey.

- Outbound cold calling/outreach has a cost too – between building lists, dialing, and sales time. Many firms find outbound CAC higher than inbound, but it can yield quality over quantity. We’ll discuss improving outbound efficiency later.

Enterprise vs SMB CAC: Enterprise-targeted businesses will see higher CAC because each deal requires more touchpoints (enterprise CAC might be 5-10X higher than SMB, depending on the product). However, enterprise LTVs are also much greater. Businesses targeting SMBs or mid-market often aim for leaner digital-heavy acquisition to keep CAC low, since smaller customers generate less revenue. For example, a product-led SaaS for SMBs might have a $200 CAC and $800 annual revenue per account – workable. But an enterprise software company might spend $20,000 CAC for a $200,000 deal – also workable due to scale. The key is ensuring CAC is proportional to LTV in your segment. If the cost to close a sale in a certain segment isn’t justified by that segment’s LTV, you may need to refocus on a different market (2).

2026 outlook: Across B2B industries, expect CACs to remain high or even increase modestly, given rising ad costs and data privacy changes making targeting harder. However, companies are offsetting this with smarter strategies (ABM, AI, better retention) which we’ll cover next. The benchmarks above provide a starting point – if your CAC is dramatically above these ranges, it’s a red flag to investigate why. If you’re below the average, you may have an efficiency edge (or perhaps you’re under-investing in growth). In any case, benchmarking helps set context, but the real goal is to improve your own CAC over time.

Proven Strategies to Reduce B2B Customer Acquisition Costs

Inbound marketing leads cost 61% less than outbound leads on average, making inbound one of the most efficient ways to reduce CAC.

Reference Source: MarketingProfs

Facing high CAC in your business? Don’t panic. There are proven strategies to reduce customer acquisition costs while still driving growth. The goal isn’t simply to spend less – it’s to spend smarter and more efficiently, getting more bang for your buck. Here we outline several strategic moves (from outbound sales tactics to demand generation and retention plays) that B2B marketing and sales leaders can use to lower CAC:

1. Optimize Your Funnel and Conversion Rates

One of the most direct ways to reduce CAC is to improve your conversion rates at each stage of the funnel. If you can convert more prospects into customers with the same spend, your cost per acquisition naturally drops. Analyze your funnel from initial lead to closed deal: where are the leakages or friction points?

Focus on conversion rate optimization (CRO) in both marketing and sales processes. Small tweaks can yield big gains. For example, A/B test your landing pages and demo sign-up forms – better messaging or simpler forms can boost lead conversion without extra ad spend (1). In a B2B context, maybe your whitepaper download form is scaring people off with too many required fields; try reducing form fields or improving the call-to-action. Or, if you offer a free trial, ensure the onboarding is smooth and engaging to maximize trial-to-paid conversion.

On the sales side, look at your proposal win rate and sales cycle length. If only 20% of proposals convert to wins, improving that to 30% means you acquire 50% more customers from the same pipeline. Sales enablement plays a role here (more on that below): equipping your sales team with better training, collateral, and product demos can increase their close rates. Also, identify bottlenecks: do deals stall at the negotiation stage? Perhaps introducing incentives or better ROI justification at that point could push more deals through.

Optimizing the funnel also means qualifying leads properly. If your sales team is chasing a lot of bad-fit leads, that’s wasted cost. Tighten your ICP (ideal customer profile) definition and lead scoring so that marketing passes only quality leads, and sales focuses time on those most likely to close. That might mean being more selective in your outbound targeting or using intent data (see advanced section) to prioritize hot prospects. The result is a higher lead-to-customer conversion rate – driving CAC down.

Lastly, don’t overlook remarketing and retargeting. Prospects who have engaged with your brand before will convert at much higher rates than cold audiences. In fact, visitors already familiar with your brand often convert 2× to 3× higher than cold prospects (1). By retargeting warm leads (website visitors, content downloaders, event attendees) with tailored follow-ups, you improve overall funnel efficiency. These are people you’ve already paid to reach once; retargeting ensures that initial spend isn’t wasted and nudges them closer to purchase at a low incremental cost.

2. Focus on High-Impact Outbound (and Consider Sales Outsourcing)

Outbound sales – such as cold emailing, calling, and LinkedIn outreach – is a staple of B2B customer acquisition. But doing outbound right can drastically lower your effective CAC by yielding a steady stream of qualified leads for relatively low cost. The key is to increase the efficiency of your outbound efforts:

- Multi-channel outreach: Don’t rely on a single channel like cold calls alone. Combine email, LinkedIn, phone, and even direct mail in coordinated cadences. Multi-channel outreach can boost response rates and meeting bookings, meaning more pipeline from the same effort. Using multiple touchpoints ensures you catch prospects where they prefer to engage, improving your outbound ROI.

- Personalization at scale: Generic mass blasts get ignored. Leverage research and tools to personalize messages with the prospect’s industry, pain points, or trigger events (like a funding announcement or new job title). Highly targeted outbound campaigns (like Account-Based Marketing, covered later) might have higher upfront effort per contact but yield much higher conversion, thus lowering CAC in the long run. Remember, quality over quantity – it’s better to thoroughly personalize outreach to 50 ideal accounts than spam 5,000 irrelevant ones and waste time.

- Use data to refine targeting: Outbound is most cost-effective when aimed at your ideal customer profile. Utilize data sources to build laser-focused prospect lists (e.g., companies in X industry that use Y technology and recently got funding). Intent data providers can flag prospects showing buying signals (searching for solutions, downloading related content) – reaching out to these leads will give your SDRs a head start and shorten the sales cycle. Companies using intent-driven targeting see dramatically higher conversion rates – some report 93% improvement in conversion by focusing on in-market buyers (4). The more of your outbound efforts that go toward truly interested prospects, the lower your cost per win.

- Protect your sender reputation: If you do cold email at scale, ensure you manage deliverability (warm up new domains, avoid spam triggers). Getting into prospects’ inboxes consistently means you’re not burning effort on messages that never get seen. This is more of a tactical point, but it can save wasted marketing dollars.

Another powerful way to reduce CAC in outbound is to leverage a customer acquisition agency, sales outsourcing, or fractional SDR teams. Partnering with an external provider (like Martal Group) that specializes in B2B lead generation can lower your cost of sales by spreading the costs across their multiple clients and using their expertise. For instance, studies show inside sales teams (often what outsourced SDRs provide) can be much more cost-efficient than field sales. Each customer contact by an inside rep might cost ~$25–$30, versus $300–$500 for a field salesperson’s contact when you factor salary, travel, and overhead. That’s a 10x cost difference per touch. Outsourced sales teams essentially act as your inside reps but without you bearing the full hiring and training cost – you get a ready-made team for a fraction of the expense of building your own.

Sales outsourcing firms also come with refined processes, tools, and data. They can ramp up outreach in weeks (whereas building an in-house team could take months of hiring and onboarding). By outsourcing portions of your outbound (like appointment setting, cold outreach, lead research), your in-house salespeople can focus on closing, which is a better use of their time. The result: more qualified leads at lower cost, and your highly paid account executives aren’t wasting hours cold calling. Many companies have found that engaging an outbound partner leads to faster scaling of pipeline and lower CAC, because the outsourced model spreads costs and operates with high efficiency (outsourcers often work on performance-based contracts, giving them incentive to deliver results cost-effectively).

Tip: If you outsource, treat them as an extension of your team. Share your ideal customer profiles, successful messaging, and let them deeply understand your value prop. A good partner will bring expertise from similar projects (for example, Martal’s team, which has experience across 50+ industries, uses proven email and LinkedIn outreach sequences honed over many campaigns). This expertise means higher hit rates and meetings booked – i.e. a lower CAC per meeting/customer than a less experienced team might get.

3. Invest in Demand Generation & Inbound Marketing

Inbound demand generation is a longer-term play, but it’s one of the most effective ways to reduce CAC sustainably. Demand gen means creating marketing that draws prospects to you (through content, search, social, referrals), rather than you chasing them. While it requires upfront investment, inbound leads often close at a lower cost because the prospects are self-educating and coming in “warm.”

Consider that inbound marketing leads cost ~61% less than outbound leads on average (10). This stat underscores how powerful content and SEO can be for cost efficiency. When you publish high-quality blog posts, guides, whitepapers, etc., they can keep generating organic traffic and leads for months or years with no additional spend. That drives down the incremental cost per lead dramatically over time (essentially just the content creation cost amortized). In 2026, having a strong content marketing engine is practically table stakes for B2B. Educate your target audience with thought leadership, solve their problems with how-to articles, and showcase results with case studies. Not only do you attract more leads, you attract better-qualified leads who resonate with your message – leading to higher close rates.

A few demand gen tactics to lower CAC:

- SEO and organic search: Ranking for the right keywords means continuous free traffic of prospects actively looking for solutions. While SEO takes time, its ROI compounds. Organic leads often have high intent and trust (since they found you naturally), yielding efficient conversions. As one report noted, organic search delivers superior ROI compared to paid channels over the long run (3).

- Webinars and podcasts: Hosting educational webinars or launching a niche podcast can pull in a targeted audience at relatively low cost. You might spend a few hundred dollars on promotion and tools, but if 100 relevant leads attend a webinar and 10 become customers, the CAC is minimal. Plus you can repurpose the content.

- Lead magnets and email marketing: Offering valuable free resources (templates, e-books, calculators) in exchange for an email is a classic demand gen move. Once you have the email, nurture those leads through automated email sequences. Email marketing is very cost-effective – as mentioned, it’s one of the lowest cost-per-lead channels because sending additional emails costs almost nothing. The key is to provide value and build trust so that when leads are sales-ready, they come to you. Maintaining an engaged email list lowers your dependence on expensive ads for every new lead.

- Social media and community building: Engaging on LinkedIn (for B2B) or other platforms can grow an audience who hears about your brand organically. It’s harder to measure direct CAC impact here, but a strong LinkedIn presence for your execs can generate inbound inquiries (essentially free leads). Also, participating in industry communities or forums where your buyers hang out can drive word-of-mouth leads.

Remember, inbound is not “free” – it takes time, content resources, and consistency. But when done well, it creates a pipeline that doesn’t require proportional spend to scale. A blog post that ranks #1 might bring in 1,000 site visitors a month with zero ad spend – perhaps 50 of those convert to leads, and 5 become customers. That’s effectively no-cost acquisition aside from the initial content creation. Evergreen content in particular (topics that remain relevant over time) can continuously feed your funnel. This can drastically pull down your blended CAC when you factor in how many customers came through these low-cost inbound channels.

Finally, inbound efforts also boost brand credibility, which improves conversion rates for your other channels. A prospect cold-called by your rep is more likely to respond or book a meeting if they recognize your brand from an article or LinkedIn post they saw. So inbound and outbound actually work together: demand gen “warms up” the market, making your outbound touchpoints hit more receptive prospects. All of this contributes to a lower overall CAC.

4. Provide Sales Enablement and Training to Boost Efficiency

Sometimes the quickest way to lower CAC is to increase the effectiveness of your sales team. If your reps close more deals from the leads you already have, your acquisition cost per customer goes down. This is where sales enablement and training come in.

Invest in equipping your sales force with the right tools, content, and skills to improve their success rates. A few areas to look at:

- Sales collateral and content: Arm your team with case studies, ROI calculators, product demo videos, and battlecards to handle objections. When salespeople have compelling content to share at the right time, prospects move through the pipeline faster with more confidence. Faster closes = lower cost (less hours spent per deal, and more throughput from the same funnel).

- Training and coaching: Regular training can significantly up your team’s game. This might include improving discovery call techniques, negotiation training, or learning how to better qualify opportunities. For example, Martal Academy’s B2B Sales Training programs are designed to sharpen reps’ skills in engaging and converting high-value prospects. By training your SDRs/AEs on best practices – whether through an internal program or external ones like Martal’s – you can see higher conversion rates. Even a modest improvement (say your SDRs book 5% more meetings, or AEs increase win rate by a few percentage points) directly lowers CAC, since more deals are coming from the same efforts.

- Messaging alignment: Ensure marketing and sales are aligned on messaging so leads get a cohesive story. If marketing attracts leads with a certain value proposition, but sales pitches something different, prospects may drop (wasting that acquisition cost). Consistent, well-honed messaging from first touch to close will improve conversion and reduce waste.

- Sales technology and automation: Utilize CRM tools, sequence automation, and playbook software to make your sales process efficient. For instance, if your sales reps manually follow up on every lead, consider automated email sequences for initial touches so reps focus on the most engaged leads. Sales engagement platforms can also prioritize tasks so reps spend time where it matters. This efficiency means the team can handle more leads without needing more headcount – effectively lowering CAC by increasing output per rep. (However, note: throwing too many tools at the team can backfire if they aren’t integrated – streamlined processes are key.)

Crucially, track performance metrics for your sales team (like conversion rates at each stage, average touches to close, etc.). These will highlight where training or enablement is needed. For example, if you see a lot of deals stuck in “proposal sent” stage, perhaps training on proposal storytelling or negotiation could help push those through, increasing your close rate.

Also, recognize and replicate top performers. If certain reps consistently close at a lower cost (maybe they use a particular technique or sequence), capture that insight and coach others. Standardizing best practices across the team lifts everyone’s efficiency.

In summary, better sales enablement = higher productivity per dollar spent on sales, which reduces CAC. Many companies focus heavily on marketing tactics to reduce CAC and forget the human element – your sales team’s skill is a huge factor. A well-trained, well-supported sales team will close more deals from the pipeline you already have, meaning you don’t need as many leads (or as much spend) to hit your customer acquisition targets. Enablement might include formal training (e.g., Martal’s training academy for outbound prospecting and closing techniques) as well as ongoing coaching and analytics to continuously improve. This is a high-ROI investment that directly shrinks acquisition cost.

5. Improve Customer Retention and Lifetime Value

It might sound counterintuitive, but one of the best ways to reduce effective CAC is to focus on customer retention and expansion. Retaining customers doesn’t directly lower the cost to acquire them initially, but it increases the value you get from each acquisition, thereby improving your CAC payback and LTV:CAC ratio. When customers stay longer and spend more, the initial CAC can be higher and still make economic sense. Moreover, happy existing customers can drive new acquisitions at low cost through referrals.

Consider these facts: Increasing customer retention by just 5% can boost profits by 25–95% (3). That statistic highlights how powerful retention is to the bottom line. If you plug that into LTV:CAC, improving retention (and thus LTV) means your allowable CAC effectively increases – or conversely, for the same CAC you’re getting much more value. Companies that focus on customer success, product adoption, and renewals often find they don’t need to acquire as many new customers to hit revenue goals, reducing the pressure on acquisition spend.

Another angle: Upsells and cross-sells to existing clients have a much lower cost than acquiring a brand new customer. Your sales team (or account managers) can often convert an upsell with a few conversations – far cheaper than the full cycle to land a new account. If your business model allows expansion revenue (selling more seats, add-on modules, etc.), make sure you’re investing in those programs. Every dollar of expansion revenue is revenue you didn’t have to spend new CAC for. B2B companies with strong expansion programs can dramatically lower their CAC ratio (CAC as a percentage of total revenue added).

Additionally, existing customers are easier to sell to: the probability of selling to an existing customer is 60–70%, whereas for a new prospect it’s more like 5–20% (3). That means your sales efficiency with current customers is far higher. Encouraging repeat purchases or contract renewals keeps CAC down because the more revenue you can generate without new acquisition spend, the lower your blended CAC per dollar of revenue.

Finally, referral programs leverage your current happy customers to bring in new ones at low cost. Customers acquired via referral or word-of-mouth often have 20–40% lower CAC than those acquired via traditional channels (1). That makes sense – a referral might only cost you a small incentive or discount, or simply the effort to ask, versus hundreds or thousands in marketing expense. And referred customers tend to close faster and have higher loyalty (because they come pre-recommended), further reducing overall acquisition and retention costs. If you don’t have a referral incentive program, 2026 is a great time to implement one. Even something as simple as, “Refer a client, and both of you get a $500 account credit or gift,” can spur referrals. Make it easy for customers to refer you (provide a shareable link or code, and gently ask for referrals when a customer hits success milestones).

Key point: Retention isn’t typically listed under “customer acquisition” strategies, but it absolutely affects the economics of acquisition. When you hold onto customers and increase their lifetime value, you can afford a higher CAC and still be profitable. Or, put another way, you can spend the same CAC and get more total revenue (since fewer customers churn). Either scenario improves your efficiency. So, ensure your customer success and support teams are focused on delivering results, mitigating churn risks, and identifying upsell opportunities. Even product improvements that boost stickiness will pay off in the form of better CAC metrics in the long run.

In summary, reducing churn and expanding revenue from existing clients is one of the most powerful (and often underutilized) levers to tame CAC. It’s the classic “leaky bucket” analogy: if you can plug the leaks (customer losses), you don’t need to pour as much in to fill the bucket. This makes your acquisition engine’s output (net new customers or revenue) much higher for the same input.

6. Leverage Automation and AI to Lower Costs

Automation and artificial intelligence have become game-changers in B2B sales and marketing – and they can directly help in reducing CAC by cutting manual costs and improving targeting. Companies that embrace AI and automation in their go-to-market are seeing efficiency gains that translate to lower customer acquisition costs:

- Marketing automation: Implement automated email workflows, chatbots, and lead nurturing sequences that cultivate leads without constant human touch. For example, an automated email drip campaign can warm up new leads at virtually no marginal cost, so by the time sales engages, the lead is more sales-ready (meaning fewer sales hours spent per conversion). Automation also ensures no leads fall through the cracks – every inquiry gets followed up systematically, maximizing the yield from your marketing spend.

- AI-driven outbound: Tools powered by AI can research prospects, personalize outreach, and even write initial email drafts for you. Instead of your sales rep spending an hour researching a company and crafting an email, an AI assistant can compile insights and a tailored message in seconds. This means your team can reach more prospects in the same amount of time, lowering the labor cost component of CAC. In fact, 88% of marketers now use AI in some form in their daily work, with 43% saying cost savings is a primary benefit (3). AI can help you do more with less – whether it’s automating lead scoring (so sales only works the best leads) or optimizing ad bidding to lower CPL.

- Intent data and predictive analytics: As mentioned earlier, buying intent signals allow you to focus on leads that matter most. Modern AI sales platforms can analyze thousands of data points – technographic data, web behavior, firm news, etc. – to predict which accounts are likely to be in market. By targeting these, companies have seen huge improvements: e.g., 82% faster conversion of intent-qualified leads and significantly shorter sales cycles (5). Faster conversions = lower cost, because each sales cycle consumes less time/resources. Additionally, intent-based advertising has been shown to be 2.5× more efficient in terms of cost-per-acquisition (6), since you’re not wasting impressions on indifferent audiences.

- Account-Based Marketing (ABM) at scale: ABM is a strategy where marketing and sales focus on a defined set of target accounts with personalized campaigns. Data and AI have made ABM far more scalable and effective. For example, AI can dynamically personalize web content or ads for target accounts, and data tools can trigger outreach when a target account shows buying signals. ABM often yields better conversion rates – one source notes companies using ABM saw a 38% higher sales win rate and 91% larger deal sizes on average (9). Higher win rates directly lower CAC because fewer marketing touches are “wasted” – more of them result in revenue. No wonder 90% of B2B organizations have an ABM program in place (9). It’s become a cornerstone of efficient B2B marketing.

- AI-assisted sales outreach: Sales teams are using AI for things like writing email sequences, analyzing call transcripts for coaching, and even AI sales callers for initial qualification. These can reduce the human cost and speed up response times. For instance, AI-driven sales dialers or chatbot qualifiers might handle the first interaction, passing only hot leads to human reps, thus saving reps’ time for high-value activities.

A concrete example of leveraging AI: Martal Group developed an AI SDR platform (with tech like GTM-1 Omni by Landbase) that analyzes over 3,000 intent signals to build targeted lead lists and craft optimized messaging. By integrating such a platform, Martal can connect with prospects at the perfect moment when they’re likely evaluating solutions, boosting response rates. The result is the team spends less time on unresponsive contacts and more time on engaged, high-intent prospects – effectively lowering CAC for their clients. This kind of AI sales automation is quickly becoming essential for B2B sales teams.

Bottom line: Smart use of automation and AI can reduce the manpower and ad spend needed to acquire each customer. Whether it’s through better targeting (so you spend only on the right eyeballs) or through process efficiency (so each sales rep covers more ground), the impact shows up as a lower CAC. Early adopters of these technologies have reported impressive improvements – for example, companies that successfully implemented AI saw significant CAC improvements in case studies (sometimes cutting CAC by 20-30% or more) (3). Even if you don’t have a huge tech budget, start with small automation wins: set up an email sequence here, use a chatbot for common inquiries, try an AI tool for social media outreach personalization. Over time these efficiencies add up and bend your CAC curve downward.

Tracking & Optimizing CAC Over Time

Companies that review CAC by channel monthly or more frequently are significantly more effective in controlling acquisition spend.

Reference Source: Yousign

Improving CAC isn’t a one-time project – it’s an ongoing discipline. To keep customer acquisition costs in check, you need to track CAC regularly and optimize as you go. Here are best practices for monitoring and managing CAC over time:

- Establish a cadence for CAC reporting: Don’t wait until year-end to evaluate CAC. Track it continuously or at least monthly/quarterly. Regular tracking lets you spot unfavorable trends early (e.g., CAC creeping up quarter over quarter) so you can adjust strategy before it hurts your business. Many companies set CAC targets each quarter as part of their KPIs.

- Monitor CAC by channel and campaign: Overall CAC is useful, but drilling down is where you find optimization opportunities. Calculate CAC (or at least CPL and conversion rates) for each major channel – paid search, LinkedIn ads, outbound email, events, etc.. Identify which channels have the lowest CAC and which are lagging. For example, you might find your CAC from webinars is half that of paid ads – a sign to double down on webinars. Within digital channels, use tracking URLs or analytics to attribute new customers to their source. This way, you can reallocate budget to the most efficient channels.

- Use tools for real-time visibility: Modern analytics tools and customer acquisition platforms (like Google Analytics 4, SaaS analytics platforms, or custom dashboards) can connect spend to outcomes in near real-time. Some companies use a marketing attribution tool to see which campaigns and touchpoints contributed to each customer, allowing them to calculate effective CAC per campaign. If possible, implement a dashboard that shows your CAC daily or weekly by channel (1). Real-time data helps you make agile decisions – for instance, pausing a campaign that’s trending too expensive or boosting one that’s outperforming. As the saying goes, “you can’t improve what you don’t measure.”

- Benchmark against yourself: While industry benchmarks are helpful, the most important comparison is your own trend. Is your CAC this quarter lower than last quarter? How does it compare to the same time last year? Aim for improving your CAC over time through the tactics discussed. Celebrate and replicate areas where you lowered CAC, and investigate areas where it rose. Sometimes rising CAC is okay if it comes with higher LTV customers (e.g., moving upmarket), but it should be intentional, not a surprise.

- Watch the CAC vs. LTV and payback metrics: As mentioned, keep an eye on LTV:CAC ratio and CAC payback period alongside raw CAC. You might tolerate a higher CAC during a big growth push, but ensure your LTV or retention is rising too, or plan for how that CAC will be paid back. If you see LTV:CAC slipping below your target (say it went from 3:1 down to 2:1), that’s a red flag to either pull back spend or re-optimize your mix.

- Regularly review cost structure: Sometimes costs creep in that inflate CAC – for example, maybe you added two new sales tools with hefty subscriptions. Reevaluate your acquisition-related costs periodically. Are there marketing campaigns that should be cut or renegotiated? Is your sales team structure optimal, or are there inefficiencies (e.g., overlapping territories causing duplicate efforts)? By trimming unnecessary costs, you reduce CAC without even touching conversion rates.

- Conduct cohort analysis: If possible, analyze CAC for different customer cohorts or segments. Perhaps enterprise customer CAC is high but their LTV is huge, while SMB CAC is lower but with short lifespans. This analysis can inform your strategy on which segments to focus on for the best ROI on acquisition.

- Incorporate CAC into decision-making: Use CAC data when planning budgets and strategies. For instance, if your paid social CAC is above your acceptable range, you might decide to allocate those funds to content marketing which has delivered lower CAC. Or if a certain trade show yielded an exorbitant CAC, maybe sponsor a smaller event or do a virtual event instead. Data-driven decisions will steadily optimize your overall CAC.

Frequency: Many experts recommend reviewing a marketing dashboard (with CPL, CAC, etc.) weekly, doing a deeper dive monthly, and a thorough analysis quarterly. At the very least, have CAC as a standing metric in your quarterly business reviews. And if you have the capability, real-time tracking is gold. According to one best practice, teams that monitor CAC daily or weekly by campaign can respond faster and maintain efficient spend (1). For example, if you see a spike in CAC in a certain channel one week (perhaps due to an ad algorithm change or a website issue hurting conversion), you can react immediately instead of finding out a month later.

In today’s environment, data is your friend. Tools like Usermaven or other analytics software can integrate multi-touch attribution and funnel analysis to attribute costs to each customer journey. They can show you, for example, that a customer interacted with 5 pieces of content and 2 ads before closing – helping assign the right cost and credit to those touches. This sophistication ensures you optimize the right levers rather than cutting something that actually was pulling its weight.

Why is tracking CAC per channel important?

Because it shows you which acquisition sources are most efficient. Your overall CAC is an average of many efforts – breaking it down by channel (e.g., paid search vs. events vs. outbound calls) helps pinpoint where you get the best value. You might find, for instance, that your CAC from LinkedIn Ads is twice that of webinars. With that insight, you could shift budget toward webinars to acquire customers at lower cost.

Similarly, if one sales development rep’s outreach is yielding a much lower CAC than another’s, you can analyze why and spread those best practices. Channel-specific CAC also helps in forecasting and scaling – if you know inbound leads cost $X each and outbound leads cost $Y, you can decide how to allocate future spend to meet acquisition goals economically. In essence, granular CAC tracking = more informed decisions = lower CAC over time.

Finally, instill a culture in your team of CAC awareness. When launching a new campaign or sales initiative, ask “How will this impact our CAC? What’s our target CAC for this effort?” This mindset keeps everyone focused on efficiency, not just top-line results. It’s not about being cheap; it’s about being smart and getting more customers for each dollar invested.

Advanced Approaches: Data, AI, and Targeting to Supercharge CAC Reduction

Companies using intent data and AI see up to a 93% increase in lead conversion rates, dramatically improving CAC efficiency.

Reference Source: MVF (Via LinkedIn)

To truly beat the benchmarks in 2026 and beyond, B2B organizations are turning to advanced, data-driven approaches. We’ve touched on some already, but let’s delve deeper into a few cutting-edge tactics that can give you a strategic advantage in lowering CAC:

Account-Based Marketing (ABM): ABM is all about quality over quantity – targeting specific high-value accounts with personalized marketing and sales outreach. It’s a strategy greatly enabled by data and technology now. With ABM, you might market to 100 target companies with highly tailored campaigns rather than 10,000 broad leads. The result is a higher close rate and larger deal sizes, which can dramatically improve CAC efficiency for enterprise sales. 90% of B2B organizations have an ABM program, indicating its mainstream adoption (9). Why? Because 81% of those say ABM delivers higher ROI than other marketing activities (9). When marketing and sales coordinate on an ABM play, you waste less effort on unqualified prospects and focus budget on the accounts most likely to convert. To do ABM well, leverage tools that can deliver personalized ads/content to specific accounts and track engagement at the account level. ABM does require investment per account, but if each account is worth a lot, the efficient win rate means lower effective CAC (you might spend more per account in marketing, but if you win 3 out of 5 targeted instead of 3 out of 100 in a broad approach, you drastically lowered cost per win).

Intent Signal Monitoring: We discussed intent data earlier – this is a game-changer for B2B. Companies are now tapping into third-party intent data sources (from providers like Bombora, 6sense, ZoomInfo, etc.) which show which accounts are actively researching topics related to your product. By monitoring these signals, your marketing can focus on accounts “in-market” and your sales can time outreach when prospects are most receptive. Only about 25% of B2B companies currently leverage intent data tools (8), despite the fact that 96% of marketers who use intent data report success with it (7). This means if you adopt it now, you can gain an edge over competitors who are slower – capturing leads while they are still figuring out their need. Intent-driven marketing has yielded conversion rate increases of over 90% for companies that implement it well, slashing acquisition costs by focusing efforts where they count. It’s like selling to someone who has already signaled “I want this” versus trying to convince someone who isn’t looking – obviously the former is more cost-effective.

AI-Powered Lead Scoring & Routing: Use machine learning models to analyze your historical customer data and identify patterns of leads that became best customers. An AI lead scoring model can then score new incoming leads (or target account lists) to tell you who’s most likely to convert and be high value. This prevents your sales team from wasting time on low-probability leads, concentrating their effort on the ones that matter. Better focus improves conversion and lowers CAC. Also, AI can auto-route leads to the rep best suited for them (e.g., based on industry or past success), which can improve close rates marginally (every bit helps!). For example, if an AI model learns that leads from healthcare industry with 500-1000 employees have a high close rate with Rep A, it can assign similar new leads to that rep automatically, likely increasing the chance of success.

Personalization at Scale: Modern data platforms enable you to personalize marketing content at scale. Rather than one-size-fits-all brochures or emails, you can tailor messages to specific verticals, job roles, even individuals. Something as simple as dynamically inserting a prospect’s company name and relevant industry stats into an email or landing page can increase engagement. According to research, advanced personalization can reduce CAC by up to 50% while also driving revenue increases (3). Why? Because personalized campaigns convert far better – prospects feel the solution is made for them, so they move forward more often. Investing in personalization (through tools or manual effort for big accounts) is an upfront cost, but it pays back with higher conversion efficiency.

Predictive Analytics for Channel Mix: Data-savvy teams are using predictive models to allocate their budget across channels optimally. Instead of purely looking backward (“last quarter our Facebook Ads CAC was $400, let’s cut it”), they use predictive analytics that account for saturation, diminishing returns, and cross-channel effects. For example, a model might predict that the next $50k spent on content will yield more customers than the next $50k on PPC. By using these insights, you put your dollars where they’ll get the best CAC ahead of time, not just after seeing results. This proactive approach can continuously keep CAC minimized.

Rapid Experimentation (Growth Marketing): Employ a growth hacking mindset – run many small experiments across the funnel to find optimizations. A/B test ad creatives, try new channels on a small scale, experiment with pricing offers or free trials, etc. If 9 experiments fail and 1 succeeds in lowering CAC by 10%, that’s a win. The key is low-cost experimentation and quickly iterating. Companies with a culture of testing often find creative ways to cut acquisition costs (like discovering an unconventional partnership channel or a referral incentive that spikes sign-ups).

Leverage Third-Party Platforms: Sometimes partnering with bigger platforms or marketplaces can offload CAC. For instance, some B2B software companies list on marketplaces (Salesforce AppExchange, AWS marketplace) – customers find them there, reducing the company’s own marketing cost. Or co-marketing with a larger firm (webinars with a big tech partner) can attract leads you wouldn’t get on your own dime. Essentially, piggybacking on another platform’s audience can bring down your cost of acquisition if done right, since you share marketing responsibilities.

In embracing these advanced approaches, ensure you have the right data infrastructure. Clean data, integrated tools, and analytics talent are needed to maximize AI and advanced strategies. It might be worth investing in an analytics platform or data analyst – the insights they unlock could directly shave double-digit percentages off your CAC by revealing where waste is and where opportunity lies.

A word of caution: Advanced tech and data give a competitive edge, but only if paired with sound strategy. If your product-market fit is off or your messaging is poor, AI won’t magically fix your CAC. Get the basics right (as covered in the earlier sections), then layer on these advanced techniques to squeeze out every efficiency.

Example: A B2B company implemented an AI-based intent scoring system and found that leads with certain behaviors (e.g. visited the pricing page twice and their company hired 3 new developers per LinkedIn) closed at 3× the rate of others. They focused sales outreach on those leads immediately, and nurtured the lower-scoring ones via marketing until their intent grew. The result? Their SDR team’s productivity doubled – same team, twice the number of deals – cutting their CAC roughly in half. This illustrates how powerful data-driven targeting can be for acquisition cost.

By harnessing data, AI, and precise targeting approaches like ABM, you can achieve what might have been impossible a few years ago: significantly beating industry-average CAC benchmarks. The companies that thrive in 2026 will likely be those who innovated in acquisition efficiency, not just those who spent the most. Fortunately, the tools to do this are more accessible than ever.

Conclusion: Achieving Efficient Growth in 2026

Customer acquisition cost is more than just a metric – it’s a window into how effective and efficient your growth strategy truly is. In 2026’s B2B landscape, where CACs are high and rising for many, companies that master their CAC will outpace those that simply throw budget at the problem. By understanding your CAC drivers, benchmarking against the market, and continuously optimizing through data, you can turn customer acquisition into a competitive advantage rather than a cost center.

We’ve explored how to calculate and benchmark B2B CAC, and more importantly, how to beat those benchmarks. From funnel tweaks and outbound precision to demand gen and retention, you have a toolkit of strategies to pull costs down while actually accelerating growth. The common thread is working smarter: targeting the right prospects, improving conversions, and leveraging modern tools like AI to amplify your team’s efforts. It’s about getting more high-quality customers for every dollar spent.

Remember, the goal isn’t zero CAC – it’s an optimal CAC that drives profitable growth. Some initiatives will pay off, others won’t, but by measuring and iterating, you’ll find the mix that works for your business. Make CAC a team sport: marketing, sales, customer success, and leadership all play a part in lowering it, whether by attracting better leads, closing efficiently, or retaining customers longer.

Finally, don’t hesitate to get expert help. If your team could use an immediate boost in pipeline without the steep cost of building it alone, consider partnering with specialists. Martal Group has helped many B2B companies dramatically reduce their cost of acquisition through our multi-channel outbound campaigns, sales outsourcing, and training. We act as an extension of your team dedicated to filling your funnel with sales-ready opportunities – at a fraction of the cost and time it would take to do internally.

In an era where every marketing dollar is scrutinized, a strategic approach to CAC is your lifeline to sustainable growth. Apply the insights from this guide, stay data-driven, and you’ll be well on your way to acquiring customers efficiently and winning in your market.

Ready to cut your CAC and scale your B2B sales? Martal Group’s experts are here to help. Book a consultation to see how our outbound lead generation services can become your growth engine for 2026 and beyond, so you can achieve more revenue with less spend. Efficient growth is possible – let’s make it happen.

References

- Usermaven

- FirstPageSage

- Genesys

- MVF (Via LinkedIn)

- Mixology Digital

- Foundry

- RollWorks and Bombora

- DemandGenReport

- Invanity Marketing

- MarketingProfs

FAQs: B2B Customer Acquisition Cost

What is considered a “good” customer acquisition cost in B2B?

There isn’t a one-size number, but a “good” CAC is one sustainable for your business model. A common rule of thumb is to aim for an LTV:CAC ratio of at least 3:1 (1). That implies your average customer brings in at least 3× the revenue (over their lifetime) of what it cost to acquire them. In practical terms, if a typical B2B customer is worth $15,000 in gross profit, spending about $5,000 or less to win that customer is healthy. The exact good CAC also varies by industry: for example, a $1,000 CAC might be great in enterprise software but terrible for a small business product. Focus on the LTV:CAC balance and compare to your industry benchmarks. As long as your customer lifetime value significantly exceeds CAC (and you have a viable payback period), your CAC is in a “good” range.

How often should we measure and revisit our CAC?

Track it continuously – at least monthly. In fast-moving B2B environments, you might even monitor CAC in near real-time by campaign. Regular tracking lets you catch inefficiencies early. At minimum, calculate and review CAC each quarter to see if you’re trending up or down. If you launch a big new marketing initiative, measure its impact on CAC in that period. And always reevaluate CAC when budgeting for the next year. Frequent check-ins ensure you can adjust spend or strategy quickly if CAC starts rising beyond acceptable levels.

Does a lower CAC always mean better performance?

Not necessarily. While lowering CAC is generally positive, ultra-low CAC can indicate underinvesting in growth. The goal is not to minimize CAC at the expense of growth. For instance, you could slash marketing spend and only take easy organic deals – your CAC would drop, but so might your pipeline. What really matters is the balance between CAC and LTV. It can be smart to tolerate a higher CAC if it brings in high-LTV customers or accelerates growth (as long as unit economics stay sound). Think of CAC as an investment: a lower “price” to acquire customers is good, but not if it comes by cutting off channels that could scale your business. So, monitor CAC and outcomes. If your CAC is extremely low and you have capacity, you might actually invest more to grow faster until that LTV:CAC ratio approaches 3:1 or 4:1. In short, efficient growth is the goal, not the lowest CAC on paper.

How can we reduce our customer acquisition cost quickly?

If you need to lower CAC in the short term, a few levers to pull: First, optimize or pause high-CAC campaigns – identify any marketing spend that’s yielding poor results (e.g., a keyword with very high cost per conversion) and cut it or reallocate to a better channel. Second, double down on referrals and re-marketing which are cheap wins – ask current clients for referrals (maybe implement a quick incentive program) and re-market to warm leads who already know you. Those typically convert cheaply. Third, consider outsourcing parts of your sales process to a specialized firm to immediately cut overhead costs (e.g., use an external SDR team rather than hiring new in-house reps, saving hiring and training costs). Fourth, improve conversion rates – do a quick sprint to fix obvious friction (maybe your demo request form is too long – shorten it and you might get more leads from the same traffic). These actions can start impacting CAC in a matter of weeks. Longer term, invest in content and SEO as sustainable ways to keep CAC down.

What factors can influence our CAC that we should watch?

Several factors impact CAC, including: Industry and target market (some sectors like enterprise IT just inherently have higher CAC due to buyer expectations), sales cycle length (longer cycles mean more touches and costs), channel mix (the more you rely on expensive channels like trade shows or PPC, the higher CAC goes), conversion rates at each funnel stage (if your website conversion or sales win rate drops, CAC rises), competition (if competitors are bidding up ad keywords or bombarding prospects, your costs to break through increase), and product pricing (if you’re selling a very high-end product, you might be willing to spend more per acquisition, whereas low-priced products need lower CAC). Also, macro factors like ad platform changes or data privacy rules can raise acquisition costs. Internally, team efficiency and tool costs also play a role. Keep an eye on all these – for instance, if you enter a new vertical and see CAC spike, it might be due to a longer sales cycle there or tougher competition, signaling you to adapt your approach.

How can Martal Group help reduce our CAC?

Martal Group specializes in multi-channel B2B lead generation and sales outsourcing, which directly helps lower CAC for our clients. By acting as your fractional sales team, Martal takes on the heavy lifting of prospecting, outreach (cold email service, LinkedIn, calls), and nurturing leads, delivering you sales-qualified appointments without you incurring the full cost of hiring and managing an in-house team. This “Sales-as-a-Service” model means you get instant expertise and scale – our reps are already trained and armed with proven outreach sequences, so they ramp up quickly and start filling your pipeline in weeks rather than months. This speed and expertise lead to a lower cost per lead and per customer. We also leverage our AI-powered platform to target prospects showing intent and personalize outreach at scale, boosting conversion rates (more meetings for the same effort). Additionally, Martal’s focus on omnichannel outreach (combining email + LinkedIn + calling) ensures no prospect opportunity is left untapped – which maximizes the ROI of your campaign. Many of our clients find that by outsourcing their SDR/BDR function to Martal, they significantly cut their customer acquisition cost – they’re essentially sharing the cost of a top-notch sales team with other clients, and only paying for a portion of it, while we deliver them qualified leads ready to close. On top of that, Martal provides guidance on best practices (through Martal Academy training and decades of experience) to improve your internal sales processes. All of this translates to acquiring customers more efficiently and at a lower cost than trying to do it all in-house or through trial and error. In summary, Martal helps you beat the CAC benchmarks by providing a cost-effective engine for outbound lead gen and sales, so your team can focus on closing deals and driving revenue.