2025 Sales Analysis Trends – How AI & Data Analytics Are Revolutionizing Outbound Sales Performance

Major Takeaways: Sales Analysis

What Makes Sales Analysis Essential in 2025?

- Sales analysis is a common evaluation method because it reflects real-time market reactions and is grounded in accessible, actionable data.

How Are AI and Data Analytics Transforming Outbound Sales?

- 81% of sales teams now use AI, with data-backed outreach driving faster pipeline growth and up to 65% lower cost per lead.

Which Metrics Should Sales Leaders Prioritize?

- Focus on both outcome KPIs (win rate, deal size) and input KPIs (touchpoints, meetings set) to identify what drives pipeline efficiency.

Where Are the Hidden Bottlenecks in Your Pipeline?

- Funnel analysis shows where prospects drop off; analyzing conversion rates at each stage reveals whether it’s a targeting, messaging, or timing issue.

How Do You Use Sales Data to Forecast Revenue?

- Teams using trend analysis and AI forecasting tools achieve 10% higher revenue predictability and improve quota accuracy.

What Are the Most Effective Types of Sales Analysis?

- Sales trend, pipeline, product, and segment analyses each offer unique insights. Combined, they provide a 360° view of performance.

Why Is Sales and Marketing Alignment Critical?

- Sales and marketing analysis exposes which lead sources convert best and ensures efforts are focused on high-ROI segments.

How Often Should You Analyze Sales Data?

- High-performing teams review sales analytics weekly or monthly, using live dashboards to iterate strategy and improve outcomes in real time.

Introduction

Sales analysis is no longer a back-office exercise – in 2025, it’s at the forefront of strategic decision-making for B2B sales teams. Why? Sales analysis is a common method of evaluation because sales data are easily accessible and directly indicate how the target market responds to your strategy (8).

In an era where every outreach, email, and call generates data, leveraging that information has become mission-critical. We’re seeing a seismic shift in outbound sales: artificial intelligence (AI) and advanced data analytics are transforming how we analyze performance, optimize pipelines, and drive revenue growth.

Imagine knowing exactly which prospects to target, when to follow up, and how to tailor your sales pitch – all based on data-driven insights. This is the promise of modern sales analytics.

In this comprehensive guide, we (the Martal team) will explore the latest trends in sales analysis for 2025 and how AI and analytics are revolutionizing outbound sales performance. We’ll cover what sales analysis entails, why it’s so important, real-world examples of sales data analysis in action, and a step-by-step guide on how to analyze sales performance. You’ll also find best practices (from choosing the right metrics to integrating AI tools) and get answers to frequently asked questions about sales analysis.

Whether you’re a CMO, CRO, VP of Sales, or SDR leader, one thing is clear: embracing data analytics in sales isn’t optional anymore – it’s a competitive necessity. Let’s dive into the trends and tactics that can sharpen your outbound strategy and boost your sales performance.

What Is Sales Analysis and Why Does It Matter in 2025?

5% higher productivity and 6% higher profits are reported by companies that make decisions based on performance data.

Reference Source: Forecast.io

Sales analysis is the process of collecting, examining, and interpreting sales data to evaluate performance and identify improvement opportunities (1). In simpler terms, it’s about auditing every aspect of your sales operation – from leads and conversion rates to rep performance and revenue trends – to understand what’s working, what isn’t, and why. By performing a structured sales analysis, organizations can pinpoint loopholes in their sales process, uncover patterns in customer behavior, and make data-driven decisions to improve results.

Why is sales analysis so crucial in 2025? Consider the following:

- Data-driven decisions outperform guesswork. Companies that use performance data to guide decisions see up to 5% higher productivity and 6% higher profits than their peers (7). Relying on intuition alone is risky – a famous example is Nokia, which dominated mobile phone sales in 2007 but fell from grace within years.

One reason? They underestimated the smartphone trend, essentially ignoring market data and ‘guessed’ their forecasts. Regular sales analysis could have signaled the shift in customer preferences, potentially altering Nokia’s fate. The lesson: in today’s fast-changing market, analyzing sales trends and customer reactions is non-negotiable for staying competitive.

- Sales data reflects market reactions. Sales analysis is a popular evaluation method largely because sales data is readily available and mirrors how the market responds to your marketing mix (8).

Every sale (or lost deal) carries information about customer needs, competitor pressures, product-market fit, and more. By analyzing this data, you’re essentially listening to your market’s feedback in real time. For instance, if sales of a product spike after a marketing campaign, that’s validation of the campaign’s effectiveness. If an outbound sequence yields poor response, the data may reveal that a particular industry segment or message isn’t resonating. Sales analysis turns daily sales records into actionable market intelligence.

- Identify issues and opportunities early. Regular analysis (monthly, quarterly, annually) helps catch problems before they snowball. Are conversion rates dropping at a certain pipeline stage? Is one region underperforming? Is a sales rep consistently missing quota?

These red flags pop out in a thorough sales performance analysis, giving you a chance to course-correct quickly. Likewise, positive trends (like a new product gaining traction) become evident, so you can double down on what’s working. In short, sales analysis is like a health check-up for your sales organization – it diagnoses issues and highlights areas to boost performance.

- Common types of sales analysis provide a 360° view. There are many flavors of sales analysis, each illuminating a different aspect of performance (we’ll explore examples in a later section). For instance:

- A sales trends analysis looks at your sales over time to spot growth patterns or seasonality.

- A sales performance analysis compares actual sales to targets, revealing if you’re on track and which teams or reps excel.

- A product sales analysis breaks down sales by product or product line to see what’s selling and why.

- And a sales and marketing analysis examines how marketing efforts translate into sales results – for example, analyzing lead sources, campaign ROI, or how changes in marketing strategy affect close rates (1).

Using the proper data analysis of sales records for each of these angles helps ensure you’re not missing the forest for the trees. You get both a macro view of overall performance and a micro view of specific drivers.

Ultimately, sales analysis matters because it provides clarity. It replaces gut feel with facts and figures. As a result, sales leaders can make informed choices – whether that’s reallocating budget to a higher-performing outreach channel, coaching a rep on a weak area, tweaking product pricing, or forecasting next quarter’s revenue with greater accuracy.

In 2025, with economic uncertainties and rapid shifts (hello, AI startups disrupting industries overnight), the companies that thrive will be those that continuously analyze and adapt their sales strategy based on real data. We are in an age where sales analytics isn’t just a report – it’s a strategic weapon.

Data Analytics in Sales – The Foundation of Performance Improvement

Organizations that monitor pipeline metrics and conversion rates are 10% more likely to achieve year-over-year revenue growth.

Reference Source: Forbes

We’ve established that analyzing sales data is important – now let’s discuss how data analytics in sales is applied to boost performance. Sales data analytics refers to using statistical analysis and sometimes advanced algorithms on your sales data to extract insights and trends. It turns raw numbers (like CRM records, call logs, revenue figures) into meaningful patterns you can act on.

Here are key ways that robust analytics drives better outbound sales performance:

- Identifying high-impact KPIs and metrics. Sales analytics starts with measuring the right sales KPIs and lead tracking. This goes beyond just total revenue or number of deals. High-performing sales organizations monitor a mix of output metrics (results) and input metrics (activities) (7).

For example, output metrics include things like quarterly sales revenue, win rate (the percentage of deals won vs. lost), average deal size, and quota attainment per rep. Input metrics cover the prospecting activities that lead to those results, like number of cold calls made, emails sent, meetings booked, qualified appointments, or demos conducted. By analyzing both, you get a full picture – not just what was achieved, but how it was achieved. Did we hit our number because we increased outreach volume (input), or because conversion rates improved (output)? Perhaps both.

Combining activity and outcome data helps pinpoint where to focus improvements. For instance, if outreach activity is high but win rates are low, that signals a need to improve lead quality or sales techniques. On the other hand, if win rates are high but pipeline volume is low, you may need more prospecting or marketing support. The sales analytics guide for any organization should define a balanced set of metrics to routinely analyze, spanning the entire funnel.

- Revealing conversion funnel dynamics. Data analytics in sales often visualizes the sales funnel or pipeline to show conversion rates at each stage. This kind of sales pipeline analysis is incredibly useful for outbound teams.

You might find, for example, that out of 1,000 cold outreach attempts, 100 leads result (10% lead rate), 30 of those leads book a meeting (30% conversion to appointment), and 10 deals are eventually closed (33% win rate from meetings). By tracking these numbers over time, you can see where the biggest drop-offs occur. Maybe a lot of leads book meetings but very few deals close – indicating a late-stage problem such as product fit or proposal quality. Or if too few prospects convert to leads in the first place, perhaps your targeting or messaging needs work.

Analyzing sales data at each pipeline stage helps you diagnose bottlenecks. In fact, organizations that systematically measure pipeline metrics and conversion rates achieve more reliable forecasts and are 10% more likely to grow revenue year-over-year, because they can address pipeline management ssues proactively (10).

- Segmentation and cohort analysis. Another powerful aspect of sales data analysis is slicing data into meaningful segments. This could mean analyzing sales by region, industry, customer size, sales rep, product line, campaign, and so on. By doing so, you can uncover patterns that average totals might hide.

For example, a sales analysis example: imagine your overall sales are flat quarter-over-quarter, but when you segment by product, you see Product A sales actually grew 20% while Product B declined 15%. That insight prompts further digging – did Product B face new competition or delivery issues? Similarly, analyzing performance by sales force (team or individual rep) might reveal that one team’s numbers are masking another’s underperformance.

Or, looking at marketing source, perhaps leads from LinkedIn outreach have a 2x higher close rate than leads from cold calling – a valuable clue for where to invest resources. Analyzing sales data through different lenses (segments and cohorts) allows you to tailor lead generation strategies for each segment. This is the essence of sales and marketing analysis: aligning both departments by examining which marketing efforts yield the best sales outcomes by segment, thereby refining targeting and messaging.

- Trend analysis and forecasting. Sales trends analysis uses historical data to identify patterns over time. Seasonality is a common example – maybe every Q3 your sales dip and then spike in Q4. Recognizing that trend means you can proactively prepare (e.g., start pipeline generation earlier for Q3 or allocate more budget before Q4 rush). Trend analysis can also show growth trajectory: are sales increasing, plateauing, or declining over the past years? Do certain product lines have momentum?

With enough historical data, you can employ predictive models to forecast future sales – projecting trends forward while accounting for growth rates or external factors. A dedicated accounting team can further refine these forecasts by analyzing financial patterns and ensuring alignment with budgeting and strategic goals.

Data analytics tools today often include forecasting algorithms that use your historical patterns plus current pipeline to predict whether you’ll hit next quarter’s targets. In fact, companies with accurate sales forecasts (grounded in detailed analysis) are 10% more likely to grow revenue than those with gut-feel forecasts (10). Modern analytics may even incorporate external data (like economic indicators or industry trends) to refine predictions. The result is more realistic goal-setting and fewer surprises. As one Harvard Business Review study noted, organizations that leverage data for decisions achieve higher productivity and profit – and nowhere is this more evident than in sales forecasting accuracy (7).

- Driving continuous improvement. Perhaps the greatest benefit of data analytics in sales is instilling a culture of continuous improvement. By measuring and analyzing results consistently, teams become more agile in tweaking their approach. For example, say your analysis of last quarter’s sales report shows that the sales cycle length (time from first contact to close) has been getting longer.

Knowing this, you can investigate why – are reps spending too long nurturing leads? Is there a bottleneck in legal/contract phase? Once identified, you can strategize how to shorten the cycle (maybe by introducing an incentive for quicker closes or using an e-signature tool to speed contracts). Then, next quarter, you measure again to see if the changes worked. This iterative loop (measure -> analyze -> improve -> repeat) is at the heart of sales performance analytics. It’s not a one-time project but an ongoing practice.

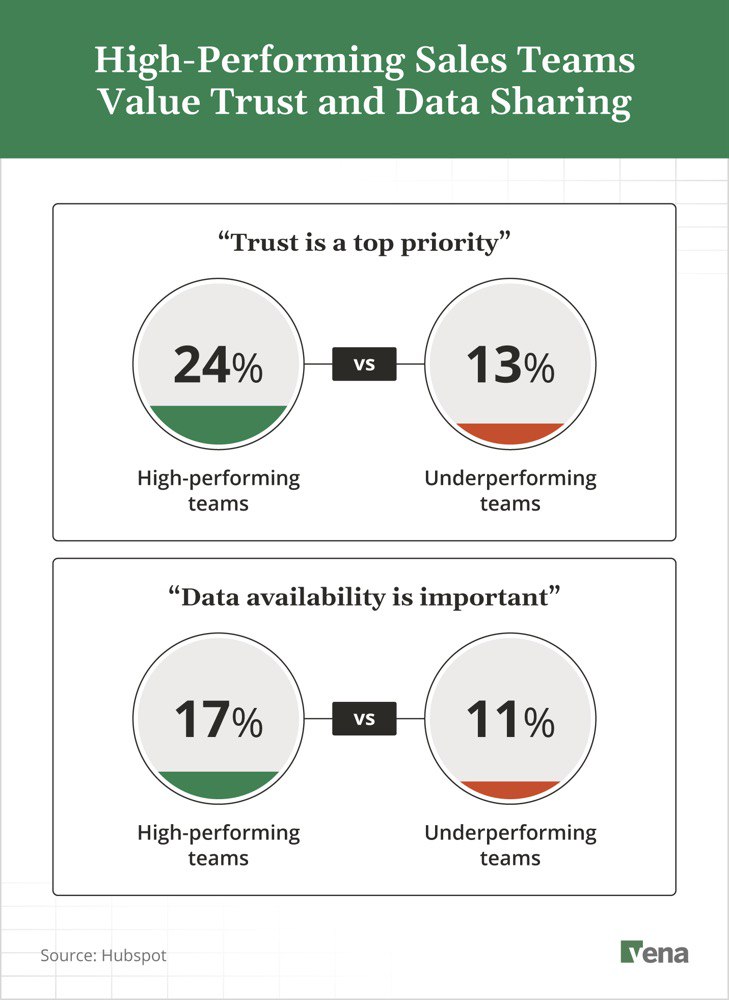

Teams that embrace it end up far more efficient and competitive. In fact, research shows high-performing sales teams foster a data-sharing and coaching culture more than underperformers – 24% of high-performers say “trust and transparency of data” is a top priority vs. 13% of underperformers (9). They know that openly analyzing data and learning from it leads to better outcomes. (See image below for a comparison of priorities in high vs. low performing teams.)

High-performing sales teams place greater emphasis on trust and data sharing (collaboration and transparency) than underperforming teams (9). A data-driven culture, where insights are shared and discussed, is linked to stronger sales results.

In summary, leveraging data analytics in sales turns your sales records into a goldmine of insights. It enables precision in how you manage your team and process – akin to having a diagnostic dashboard for your sales engine. Rather than flying blind or acting on hunches, your sales strategy becomes guided by evidence. For outbound sales, where efficiency and targeting are everything, this means higher conversion rates, more predictable pipelines, and ultimately, more sales.

Now, data analytics alone is powerful, but add artificial intelligence into the mix, and you truly revolutionize outbound sales. In the next section, we’ll look at how AI is turbocharging sales analysis and performance.

AI in Outbound Sales – Revolutionizing Sales Performance Analytics

81% of sales teams in 2024 reported using AI to enhance productivity and performance.

Reference Source: Salesforce

It’s 2025, and AI isn’t science fiction for sales teams – it’s daily reality. From AI-driven prospecting tools to “sales bots” that draft emails, artificial intelligence has firmly entered the sales arena. In fact, 81% of sales teams are now investing in AI, with about half already fully implementing AI-based workflows and the other half still experimenting (6). Outbound sales, in particular, has been transformed by AI technologies that automate routine tasks, personalize outreach at scale, and glean insights from vast data. Let’s explore how AI is revolutionizing sales performance analytics and outbound sales execution:

- Surging adoption of AI tools: The adoption stats alone tell a story of rapid change. In 2023, only about 24% of sales teams reported using AI tools – but by 2024 that jumped to 43% of sales teams using AI, essentially doubling in one year (2). This surge reflects a clear reality: your competitors are embracing AI to work smarter, and you cannot afford to ignore it.

Companies deploying AI in sales are already seeing concrete benefits. Salesforce found that 83% of sales teams using AI have seen revenue growth in the past year, versus 66% of teams without AI (6). In other words, there’s a strong correlation between AI adoption and sales success. No surprise that sales leaders are bullish – 60% of business owners predict AI will drive sales growth in the coming years (5). We at Martal have observed similar trends with our clients: those leveraging AI-driven outreach see pipeline and performance gains that traditional methods struggled to achieve.

Sales teams are increasingly turning to AI to boost performance, improve customer engagement, and streamline operations. Here are some key insights on how AI is shaping the future of sales (6):

- 81% of sales teams are investing in AI

- Half are in the experimentation phase

- The other half have fully implemented AI tools

- 83% of AI-enabled sales teams saw revenue growth in the past year

- Compared to 66% of teams not using AI

- Top 3 areas AI is improving:

- Sales data quality and accuracy

- Understanding customer needs

- Personalization for customers

- AI-using teams are 1.4× more likely to report headcount increases year-over-year

- 33% of sales ops professionals using AI say they face constraints such as:

- Limited budget

- Insufficient staffing

- Inadequate training

- Most common preparation strategy: Consolidating tools and tech stacks to improve efficiency

While AI adoption in sales is delivering measurable gains, from revenue to customer experience, many teams still face growing pains. Budget, training, and tool alignment remain critical focus areas to unlock AI’s full potential.

- AI automates the drudgery, freeing reps to sell: One of the biggest impacts of AI is automation of repetitive tasks that used to eat up sales reps’ time. Consider outbound prospecting: Traditionally, SDRs might spend hours researching prospects on LinkedIn, compiling lead lists, and sending out generic B2B cold emails. Today, AI-powered tools can handle large parts of this process.

For example, Martal’s proprietary AI sales platform automatically verifies contact info, researches prospects’ firmographics and intent signals, and even drafts personalized first-touch emails.

Similarly, AI dialers can automate call cadences. The result? Sales development reps spend far less time on admin and more time engaging live prospects. On average, sales reps historically spent only ~28% of their time actually selling, with the rest on non-selling tasks (3).

AI is helping flip that ratio. By taking on tasks like data entry, lead scoring, and email sequencing, AI gives reps hours back in their day. More selling time means more pipeline. It’s common now to see teams using AI assistants to schedule meetings, update CRM fields, or even answer basic prospect inquiries via chat – all things that scale a rep’s capacity.

In outbound sales, volume and timing are vital, and AI allows you to significantly scale up outreach without scaling up headcount, all while ensuring no prospect slips through the cracks.

- Intelligent targeting and lead scoring: Outbound efficiency depends on aiming at the right targets. This is where AI-driven sales performance analytics truly shine. Machine learning models can analyze your past deal data to find patterns of what a “hot” prospect looks like – which industries, company sizes, roles, or behaviors correlate with higher close rates. Using these patterns, AI tools can score inbound sales leads or even entire prospect lists so your team focuses on the most promising opportunities.

For example, an AI might analyze that prospects in the software industry who have recently hired new executives and use XYZ technology have a high likelihood to need your solution – and prioritize those accounts.

At Martal, we leverage an AI engine that sifts through over 3,000 buying intent signals to pinpoint companies actively searching for solutions like our clients’ offerings. This predictive sales analysis boosts conversion because reps spend time on sales ready leads that are more likely to convert, instead of chasing every contact equally. The data backs it up: high-performing sales teams are 1.9 times more likely to use AI for tasks like predictive lead scoring than underperformers (11). It’s a classic case of working smarter, not just harder.

- Personalization at scale with AI: Outbound sales emails and calls have long suffered from being either manual (personalized but low volume) or automated (high volume but templated). AI is erasing that trade-off. Modern AI language models (like GPT-4) can craft personalized email copy in seconds, drawing on data about the prospect’s industry, pain points, or even recent news. They can adjust tone and messaging based on what resonates best with a given segment.

For example, if a target prospect just posted on LinkedIn about needing to improve outbound lead generation, an AI can draft an email that directly references that post and offers a tailored solution – something a generic sequence would never do. These advancements mean outbound campaigns can achieve mass outreach without sounding like spam. One study noted that 71% of customers expect personalization, and those experiences make them 80% more likely to buy (4).

AI enables a level of personalization (in both email and even voicemail/ cold call scripts) that would be impossible to do manually at scale. The outcome? Higher engagement rates. It’s not unusual to see AI-personalized campaigns get significantly better reply rates than traditional mail-merge blasts. In fact, AI-driven content recommendations and personalization are among the top 3 areas where sales teams see improvement from AI – including better understanding of customer needs and data accuracy (6).

- AI-enhanced coaching and performance analysis: AI isn’t just prospecting for you; it’s also analyzing your sales conversations and results. Conversation intelligence platforms like Gong and Chorus use AI to transcribe sales calls and then analyze them for insights – detecting things like which talk tracks correlate with successful deals, or where reps talk too much vs. listen.

They can even flag keywords (e.g., competitor names or pricing discussions) to help managers coach reps on handling objections.

For outbound SDRs, AI can analyze call recordings or email threads and provide feedback at scale (“you mentioned the competitor’s product but didn’t mention our differentiator”). Essentially, every rep can have an AI assistant giving them tips, similar to having a manager shadow every call.

Sales performance analysis gets a boost too: AI can churn through mountains of data (every CRM update, every activity) and surface patterns no human analyst might notice.

For example, it might find that outreach emails sent in the morning have higher reply rates for one industry, or that a particular sales playbook yields shorter sales cycles. These are actionable gold nuggets for improving strategy.

Some teams even use AI to forecast sales more accurately by considering hundreds of signals (marketing engagement, sales activities, historical patterns) – often outperforming simple spreadsheet forecasts. It’s telling that 57% of reps in a survey said they miss quota due to poor visibility into their own performance (7) – AI is helping change that by providing real-time, granular performance data and recommendations to every team member.

- Scaling outreach through “autonomous” sales agents: A cutting-edge trend in 2025 is the rise of autonomous AI agents for sales – essentially bots that can execute simple outbound tasks on their own. For instance, an AI agent might handle the initial email conversation with a prospect: if the prospect replies with interest, the AI can respond back with more info or propose a meeting time, only handing off to a human rep once the lead is warmed up.

These AI sales agents use natural language processing to carry conversations that feel human. While still in early adoption, they hint at a future where parts of the sales development role can be augmented heavily by AI. Companies in tech hubs (like those in California’s surging tech scene) are already experimenting with autonomous outbound sequences (5).

Imagine having a virtual outsourced SDR team working 24/7, initiating outreach and following up on hundreds of leads simultaneously. The key, of course, is ensuring these AI-driven touches remain personalized and not robotic – but advances in GPT-type models are making that feasible. For now, most organizations use a hybrid approach:

AI handles the heavy lifting of research, initial outreach, and follow-ups, while human salespeople focus on high-value conversations and closing. This “human + AI” team can massively scale outbound capacity. One result we’ve seen at Martal: our integration of AI and automation in cold outreach helped a client triple their sales pipeline growth rate while reducing the cost per lead by 65% compared to traditional methods. That’s the kind of game-changing efficiency AI brings.

To sum up, AI in outbound sales is like giving your sales team superpowers. It amplifies the quality of your outreach (through better targeting and personalization) and the quantity (through automation and scalability). The data confirms it’s worth the investment – not only are AI-enabled teams achieving higher growth, but they’re also more likely to hit quotas and expand headcount due to the success they’re seeing (9).

If you’re concerned about the learning curve, know that sales professionals are upskilling quickly: two-thirds of sales pros have taken AI courses through work, and half are learning AI tools on their own (they recognize the importance) (9). The bottom line: AI isn’t replacing salespeople; it’s making them vastly more effective. The organizations that blend the art of selling with the science of AI and analytics will dominate in the coming years.

(As a side note, it’s crucial to integrate AI thoughtfully – success requires training your team to use AI outputs, adjusting processes, and maintaining a human touch where it counts. But that’s perhaps a topic for another day. Now, let’s shift from trends to practice: how do you actually perform a sales analysis step by step?)

How to Analyze Sales Data: Step-by-Step Guide

Clean data improves forecasting accuracy by up to 25%

Reference Source: Forecastio

So far, we’ve covered why sales analysis is vital and how AI and analytics are changing the game. Now let’s get practical. How do you analyze sales data in a systematic way? What are the steps involved in a thorough sales performance analysis?

In this section, we’ll outline a step-by-step process. Think of this as a sales analytics guide that you can follow to evaluate your own outbound sales performance.

We’ll break it into 7 steps of sales analysis, covering everything from data collection to action planning. Whether you’re doing a quarterly review of your SDR team’s results or a deep dive into a year’s worth of sales data, these steps will keep you on track.

Step 1: Define Your Goals & Key Metrics – Begin with the end in mind. Before diving into data, clarify what questions you want answered or what goals you’re evaluating. Are you analyzing sales performance to explain why a revenue target was missed? Looking for ways to improve win rates?

Assessing which outreach channel works best? Having clear objectives will focus your analysis. From there, determine lead generation KPIs related to those goals. For example, if your goal is to improve outbound efficiency, you might look at metrics like emails sent, response rate, meetings booked, opportunities created, and deals closed from outbound leads.

If evaluating individual rep performance, you’ll gather metrics like each rep’s quota attainment, average deal size, call volume, etc.

Choosing the right metrics is crucial – too few and you miss insights, too many and you get lost in the weeds. Identify the core measures of success for your sales process (leads, conversion rates, revenue, etc.), as well as any problem indicators you’ve observed (e.g., rising customer acquisition cost or slipping pipeline velocity). In short, decide what “success” looks like and what data best captures it. This will keep your analysis aligned with business outcomes rather than just number-crunching for its own sake.

Step 2: Collect Sales Data (Gather & Consolidate) – Get all your data in one place. Pull the relevant data from all sources into a single view or dataset. This typically includes exporting data from your CRM (e.g., Salesforce, HubSpot), spreadsheets, marketing automation tools, or any database where sales activity is tracked. For outbound sales analysis, key data sources might be: your CRM’s opportunity records, a CSV of leads contacted with outcomes, call logging software, email engagement reports, and possibly marketing campaign data for those leads. It’s important to gather both quantitative data (numbers like counts, amounts, dates) and qualitative data (notes from reps, call transcripts, reasons deals were lost). Imagine you’re doing a proper data audit.

Ensure you have data on each stage of your sales funnel: leads -> contacts made -> meetings -> proposals -> closed deals, including

timestamps if you plan to analyze sales cycle length. If you want to analyze sales performance thoroughly, also gather data on each sales rep’s activities and results. Modern CRM systems simplify a lot of this by holding many data points in one place, and you can use CRM reports or BI tools to extract them.

If not, even a simple Excel or Google Sheet can serve to compile the data. The key is to have a comprehensive dataset where you can see the entire picture. Tip: Ensure data consistency – e.g., if you’re merging data from multiple sources, align the formats (use consistent date formats, unify how reps or regions are named, etc.) to avoid confusion later. This step can be time-consuming, but email list cleaning and well-structured data is the backbone of a reliable sales analysis.

Step 3: Clean and Organize the Data – Before analysis, tidy up. Now that you’ve collected data, take time to review and clean it. Proper data analysis of sales records requires that those records be accurate and structured. This means checking for errors, duplicates, or missing values.

For instance, remove duplicate deal entries, fill in any missing data that’s critical (or at least note it), and correct obvious errors (e.g., a deal value listed in the wrong currency or an outlier that is clearly a data entry mistake). It’s also wise to segment or label the data for analysis.

This could involve adding columns or filters like “Region,” “Industry,” “Lead Source,” “Sales Rep Name,” “Product Category,” etc., if not already present, so you can slice the data easily. Organize leads and the dataset in a logical way – for example, each row might be a sales opportunity or account, with columns for all relevant attributes (date created, lead source, owner, status, revenue, etc.).

If you’re analyzing activities, you might have one row per call/email logged. In some cases, you’ll create summary tables – e.g., total sales by month, or by rep – to make analysis easier. The goal is to structure the data so that it’s ready to be grouped, filtered, and analyzed without a lot of manual fiddling.

Data preparation might not be glamorous, but it’s incredibly important. As the saying goes, “garbage in, garbage out” – if your data is messy, your analysis conclusions could be flawed or hard to trust. Invest the effort here and your insights later will be much more meaningful.

Step 4: Choose a Sales Analysis Method (or Multiple) – Decide how you will analyze the data to meet your goals. There are various types of sales analysis techniques (1) and you should pick the ones that fit your questions. Here are some common methods and when to use them:

- Trend Analysis: If you want to see how metrics are moving over time (e.g., monthly sales, quarterly pipeline growth), plot the data chronologically. This is great for identifying increases, decreases, or seasonal patterns.

- Comparative Analysis: To evaluate performance, compare actual results against targets or benchmarks. For example, perform a sales performance analysis by comparing each rep’s sales to their quota, or this year’s revenue vs. last year’s (YOY growth).

- Funnel/Pipeline Analysis: Visualize the drop-off at each stage of your sales funnel. Calculate conversion rates from stage to stage (Lead to Opportunity, Opportunity to Win, etc.). This pinpoints where prospects fall out and if your funnel is healthy (e.g., do you have enough leads at the top to meet targets at the bottom?).

- Cohort or Segment Analysis: Break the data into cohorts or segments to compare them. For instance, analyze sales by product (product A vs B), by customer type (SMB vs enterprise), or by campaign. This method finds differences in performance across categories.

- Win/Loss Analysis: Dig into deals won versus deals lost in a period. What characteristics do the won deals share? Why were the lost deals lost (based on rep notes or closed-lost reasons)? This can reveal, for example, that a competitor is beating you in a certain segment or that pricing is a common obstacle.

- Ratio Analysis: Look at efficiency metrics like win rate, lead-to-deal conversion %, average touches per deal, sales cycle length, average deal size, etc., and see how they stack up against prior periods or industry benchmarks. These ratios often tell more than raw totals (e.g., a higher win rate might offset fewer opportunities).

Often, you’ll use a combination of methods. For example, you might start with trend analysis to see a revenue dip, then do funnel analysis to discover the dip is due to fewer opportunities, then do segment analysis to find it’s primarily in one region, and finally win/loss analysis to figure out what’s happening in that region. In practice, analyzing sales is an iterative exploration – your initial method might lead you to another question and another method. Still, having a plan upfront (like “I will perform a pipeline conversion analysis and a by-rep performance comparison”) gives you a roadmap. If you’re not sure, a good default approach is: overall trend -> funnel metrics -> segment breakdown -> individual performance. That sequence tends to surface insights in a logical flow. And remember to leverage tools: a CRM dashboard, Excel pivot tables, or business intelligence software can all help apply these methods quickly (with charts, graphs, etc.).

Step 5: Analyze the Data and Extract Insights – Roll up your sleeves and dive in. With your methods chosen, it’s time to crunch the numbers and interpret them. Go through each analysis you planned and note the findings. For example, you might calculate that your outbound prospecting this quarter generated 500 leads (up 10% from last quarter), but the conversion from lead to meeting dropped from 20% to 15%. That’s an insight – something changed in how leads are worked or qualified. Ask “why” at each finding: Why did conversion drop? Was it a staffing change, a list quality issue, or external market conditions?

The data might offer clues (perhaps by showing which sales development representative had lower conversion or which campaign source declined). Look for patterns and outliers. Maybe one product line over-performed – dig in to see if a particular salesperson championed it or if a market trend drove it (e.g., a new feature launch). Perhaps your analysis shows the sales cycle stretched by 10 days on average – correlate that with any changes in process (did you start targeting bigger clients that naturally take longer? Did legal reviews slow things?).

It’s helpful to frame insights in terms of problems or opportunities. For instance: “We’re generating plenty of leads, but our data shows a drop in conversion at the demo stage – this is a problem of lead qualification or demo effectiveness.” Or “Our win rate in the healthcare sector is 2x higher than other industries – this is an opportunity to focus more resources there.”

Quantify wherever possible: e.g., “Rep A closed $200k, 25% above target, whereas Rep B closed $150k, 10% below target. Rep B’s pipeline was actually larger, indicating a lower win rate that should be addressed via coaching.”

Be sure to leverage any AI or analytical tools during this step – for example, if you have access to an AI assistant, you can query it in plain language: “Which lead sources had the highest ROI?” or use it to forecast outcomes (“Given these trends, where will we land next quarter?”). If you’re using a tool like Gong for call analysis, incorporate those qualitative insights too (e.g., common objections prospects raised).

The aim in this step is to translate numbers into a narrative: what story is the data telling about your outbound sales? Perhaps the story is “We over-invested in a channel that’s not converting” or “Our new sales playbook is yielding shorter sales cycles and it’s paying off.” It can be useful to list out key findings as bullet points, which will later feed into your report or presentation. At Martal, when we do this for our clients, we focus on delivering clear insights like “X is up by Y% due to Z” or “The data indicates we should do more of A and less of B.” As you extract insights, start thinking about recommendations that naturally flow from them – that’s the next step.

Step 6: Draw Conclusions and Plan Actions – Insights are only as good as the actions they inspire. In this step, you interpret the findings and decide what should be done about them. Essentially, you answer: So what? What do the results of your sales analysis mean for your strategy and tactics going forward? This part is about turning analysis into an action plan. For each key insight identified, determine if it indicates a strength to capitalize on, a weakness to fix, or an experiment to try. For example:

- If your analysis revealed that a certain outreach cadence yielded far higher reply rates, your action might be: “Standardize this winning cadence across the team and A/B test similar approaches for other segments.”

- If you found a bottleneck in the proposal stage (say many deals stall there), an action could be: “Provide reps with additional training on proposal delivery or introduce a sales engineer earlier to help prospects through technical concerns.”

- If sales to Product X are lagging, action might be: “Coordinate with marketing to create a targeted campaign for Product X or bundle it with our best-seller to boost adoption.”

- If a rep is underperforming in conversion, action: “Implement coaching or pair them with a mentor, focusing on the discovery call techniques (where the data showed they struggle).”

- If outbound emails to C-level prospects have low engagement but phone calls have higher success (hypothetically), action: “Shift more SDR time to calling C-levels directly and keep email follow-up as a secondary action.”

As you plan actions, prioritize them based on impact and effort. Not every insight will warrant immediate change – pick the ones that align with your strategic goals and will move the needle the most. It’s often useful to tie each action to a metric to track going forward (so you can later measure if the change had the desired effect). For instance, “Improve demo-to-proposal conversion rate from 50% to 60% by implementing a new demo format – assign team members X and Y to this project.” This way, your sales analysis feeds a continuous improvement loop.

Also, celebrate positives you discovered. Sales analysis isn’t only about finding problems; it’s also confirming what works. If a particular sales analysis example from your data shows, say, that deals close faster when a product specialist joins sales calls, you might conclude to keep doing that and even expand it.

In drawing conclusions, maintain a consultative mindset (especially if you’re presenting to executives): focus on the business implications. For example, “By reallocating 20% of our SDR effort from Channel A to Channel B, we project an additional $X in pipeline per quarter, based on the higher conversion rates seen in Channel B.” That ties the analysis back to tangible outcomes like revenue.

Finally, document these conclusions and recommended actions clearly. Many people use a slide deck or a memo format for this, with sections like “Key Findings” and “Recommendations.” This brings us to the final step – reporting.

Step 7: Present and Implement Your Sales Analysis (Report & Follow-Up) – Show and tell, then execute. The last step is to compile everything into a digestible format for stakeholders and then drive the agreed-upon actions. Start by creating a sales analysis report or presentation that highlights the most important insights from your work. The report should be tailored to your audience. For a quick team huddle, a one-page summary or a few slides might do. For an executive meeting, a more formal report with visuals (charts and tables) and commentary might be needed.

A good structure for the report is:

- Introduction (objectives of the analysis),

- Findings/Insights (bullet points or visuals showing key data points discovered),

- Conclusions (what it means – e.g., “Insight: Conversion down 5%. Conclusion: Need to improve lead quality or sales approach.”),

- Recommendations/Action Plan (specific steps to take). Use clear visuals: charts showing trends, bar graphs of performance by rep, funnel diagrams illustrating conversion, etc., as appropriate.

Visualizing the data helps stakeholders grasp it quickly. For instance, including a chart of conversion rates across stages with a highlight on the drop-off stage can be very persuasive (“see, here’s where we lose most deals”). Ensure to include any relevant external benchmarks too – e.g., “Our win rate is 18%, while the industry average is ~20-25% (7), indicating room for improvement in closing efficiency.”

Make the report actionable. For every issue found, stakeholders will want to know “What do we do about it?” – which you’ve already prepared in Step 6. Clearly state who needs to do what. It might help to assign owners and timelines: e.g., “By next month, we (Martal team) will implement a new lead scoring criteria to address lead quality issues” or “SDR Manager will run coaching sessions on objection handling to improve proposal conversions in Q2.”

After presenting the analysis and getting buy-in on the action plan, it’s all about implementation. As a sales leader or analyst, you should follow up that the changes are put into practice. Maybe it’s scheduling the training, adjusting the cadences in your sales engagement platform, or working with marketing on new content – execution is where the value of analysis is realized. A common mistake is doing a great analysis and then filing the report away; avoid that by making it a living plan.

Finally, set a date to reanalyze the data after changes have been in effect (e.g., “We’ll review these metrics next quarter to see if there’s improvement”). This closes the feedback loop and ensures that the sales analysis process is continuous, not a one-time event.

By following these seven steps – Define goals, Collect data, Clean data, Choose methods, Analyze data, Plan actions, Report & implement – you can confidently answer how to analyze sales performance for your organization. It provides a structured, repeatable approach.

And once you’ve done it a few times, you’ll likely develop a standardized template for your sales analysis report, making future analyses even smoother. Remember, consistency is key: the more regularly and systematically you analyze sales data, the easier it gets to spot trends early and keep improving your outbound sales outcomes.

(Now that we’ve covered the process, let’s consider some specific types of sales analysis and examples in the next section – this will give you ideas of the different angles you can examine to evaluate and boost your sales.)

Types of Sales Analysis & Real-World Examples

Sales analysis isn’t one-size-fits-all. Depending on your business questions, you’ll perform different types of analyses. Let’s explore several types of sales analysis that outbound teams commonly use, along with examples of insights each can provide.

Understanding these types will help you zoom into specific aspects of your sales performance. We’ll also incorporate some real-world scenarios (including sales data analysis examples) to illustrate the value of each approach.

1. Sales Performance Analysis (vs. Targets) – This is the classic measure of how your sales results stack up against goals or quotas. It answers “Are we meeting our sales targets?” and “Who on the team is exceeding or lagging behind?”.

For example, say your quarterly revenue target was $1M and your team achieved $900k – a performance analysis highlights that shortfall (90% of target) and prompts investigation. At a more granular level, you might find Rep Alice achieved 110% of quota while Rep Bob achieved 75%.

Example Insight: By conducting this analysis, you discover Alice closed more deals by focusing on a new market segment, whereas Bob struggled with longer sales cycles in his territory. This informs re-balancing territories or sharing Alice’s tactics with the team.

A sales performance analysis uses metrics like conversion rate, average deal size, and quota attainment to determine if the sales process is optimized to hit goals. If the data shows performance below projections, leadership can adapt strategy or provide support to correct the trend (1).

In outbound contexts, this often involves examining if the team is generating enough pipeline (through prospecting activities) to feed the quotas – e.g., maybe each SDR needs to produce 50 opportunities per quarter for the AEs to close their targets, and the analysis shows only 40 per SDR are coming through, indicating a need for more outreach or higher conversion rates.

2. Sales Trend Analysis (Historical Trends) – This type looks at sales data over time to detect patterns or momentum. It addresses “How are our sales trending over months/quarters/years?”. For instance, an annual trend analysis might show that each Q4 your sales spike significantly (perhaps due to holiday seasonal effect or year-end budget use by clients).

Example Insight: A SaaS company’s trend analysis over 3 years reveals that new customer acquisition dips in Q3 consistently. Investigating further, they realize that many prospects are on summer vacations in Q3, delaying sales cycles – so they adjust by shifting some marketing and lead generation campaigns to late Q2 and intensifying Q4 efforts to catch up.

Historical trend data is also useful for forecasting; if you have a steady 10% quarterly growth trend, you might predict the next quarter to be roughly 10% higher (then adjust for known changes or anomalies).

Another real scenario: a trend analysis might highlight that your outbound email response rates have been declining each month for the past six months – a sign that email fatigue or email deliverability issues need attention. The beauty of trend analysis is that it can turn data into a visual story (like a line chart going up or down) which is easy for stakeholders to grasp. It’s essential for planning (budgets, hiring, etc.) and for alerting you to any downward drift that needs correction.

3. Sales Pipeline (Funnel) Analysis – We touched on this earlier: analyzing each stage of the sales pipeline to evaluate conversion rates and B2B sales funnel health. It asks “Where in the sales process are we losing prospects?” and “Do we have enough volume at each stage to meet targets?”.

Example Insight: Imagine your pipeline analysis for last quarter shows: 1,000 cold leads → 100 qualified opportunities (10% conversion to opp) → 20 proposals (20% conversion) → 10 wins (50% conversion from proposal).

If you needed 15 wins to hit target, you immediately see the funnel didn’t have enough coming in on top or converting through. You also see the weakest link: only 10% of leads became opportunities, which might indicate a list quality issue or ineffective initial contact approach.

In a real company scenario, suppose after training the SDR team and refining the outreach messaging, the next quarter’s analysis shows 1,000 leads → 150 opps (15%) → 30 proposals (20%) → 15 wins (50%). That improvement at the top-of-funnel was what you needed – an actionable result from pipeline analysis.

Additionally, pipeline analysis by segment can be revealing: e.g., your enterprise leads might convert from meeting to proposal at 50% (because they’re well-qualified), while SMB leads convert at only 20%. That could shift your focus towards enterprise accounts for efficiency, or conversely push you to find ways to better qualify SMBs.

Outbound sales teams rely heavily on funnel metrics like contact-to-meeting and meeting-to-close rates; this analysis will tell them if their prospecting volume and quality are sufficient. It’s common to create a simple funnel visualization for management with these ratios – a powerful way to communicate sales effectiveness.

4. Product or Service Sales Analysis – This analysis breaks down sales by product, service, or product category to see which offerings are performing best. It answers “What are our bestsellers and underperformers, and why?”.

Example Insight: Let’s say you offer three product tiers. A product sales analysis shows 70% of new deals are for the mid-tier product, 20% for the premium, and 10% for the basic. If your strategy was to upsell customers to premium, this might indicate the value prop of premium isn’t convincing enough or pricing is a barrier.

On the other hand, maybe the mid-tier’s popularity is a good thing because it has the highest profit margin. By analyzing further, you might discover that premium-tier sales mostly come from healthcare industry clients, who need the extra features – an insight that could shape your marketing (target more healthcare prospects for premium). Meanwhile, basic-tier has low sales and lowest retention – maybe it’s time to discontinue or revamp it if it’s not adding much value.

Real-world example: Think of a telecom company analyzing sales of their various subscription plans; they might find that a new unlimited data plan is cannibalizing the older limited plans (a deliberate strategy success) – their sales analysis example would confirm the shift in product mix and guide them on plan offerings.

A product sales analysis can also tell you when and why certain products are purchased (1) – e.g., perhaps one product sells most in Q1 because that’s when budgets reset. Such info helps with inventory, staffing, or promotional timing in B2B contexts as well (for services, it could inform when to ramp up outreach for a particular service line). Overall, this analysis ensures you understand revenue composition and can make strategic decisions about product focus.

5. Customer Segment Analysis (Sales by Customer Type) – Here, you analyze sales by segmenting your customers or prospects: common cuts are by industry, company size, region, or channel. It asks “Where (or with whom) are we most successful, and where are we struggling?”.

Example Insight: Suppose you segment your last year’s sales and see that 50% of revenue came from the Tech industry, 30% from Finance, 15% from Healthcare, and 5% from others. If your strategy was to diversify into Healthcare, clearly it’s lagging – you might allocate more marketing there or examine if your offering needs tweaks for that vertical. Another insight might be regional: maybe your EMEA sales are growing faster than North America, suggesting a market shift or untapped potential.

Sales by company size could show, for instance, that mid-market clients have the fastest sales cycles and lowest acquisition cost, whereas enterprise deals, though larger, take 6-9 months to close and often slip – an insight that could influence resource allocation and quota planning.

Real example: A SaaS company finds through segment analysis that their product is especially popular with fintech startups (something they hadn’t explicitly targeted). This prompts them to create tailored messaging for fintech and even develop a case study in that space, doubling down on a natural strength.

Conversely, the analysis might highlight gaps – e.g., “We have almost no customers in Manufacturing. Is that a huge untapped market or is our product not a fit there?”

Either way, it informs strategy. In outbound sales, segment analysis can also guide personalization – if you know conversion rates differ by industry, you’ll tailor your outreach differently (our team at Martal often adjusts cadences and value propositions by vertical because analysis shows each segment responds to different pain points). The big benefit is ensuring your sales strategy is aligned with where the real opportunities lie.

6. Win/Loss and Sales Effectiveness Analysis – This involves analyzing the outcomes of deals (won vs. lost) and the factors behind them, as well as sales activities effectiveness. It overlaps with performance analysis but dives deeper into why deals are won or lost and how effective your sales process is.

Example Insight: You review all lost deals in the last 6 months and categorize reasons: 40% lost to competitor X, 30% lost to “no decision”, 20% lost on price, 10% other. This is hugely instructive – losing nearly half to a competitor shows you need to better differentiate your offering or maybe adjust pricing if competitor X is undercutting. “No decision” being high often means prospects didn’t see enough value or urgency, indicating a need to refine your value proposition or targeting.

This analysis could lead directly to competitive enablement sessions or new objection-handling training for the team. On the win side, maybe you find a common thread that 70% of won deals had a demo with a sales engineer involved – reinforcing the value of that practice (and you decide to involve SEs more often). Additionally, sales effectiveness analysis looks at things like average touchpoints per deal, response times, etc.

For outbound, you might analyze that deals which were contacted within 1 hour of lead generation had a 2x higher close rate – an argument to improve speed-to-lead in your process. Or you measure how many calls on average it takes to engage a prospect in conversation (say 6 calls) – aligning with known stats that it often takes 6+ attempts to reach prospects.

If your team gives up after 3 attempts on average, the analysis would clearly show a gap to fix (and you could reinforce persistence as a best practice). Essentially, win/loss and effectiveness analysis shines a light on sales execution quality.

7. Marketing and Sales Alignment Analysis – This examines the interplay between marketing efforts and outbound sales results. While not always considered a separate “sales analysis,” it’s incredibly valuable to analyze how leads flow from marketing to sales and how marketing initiatives impact sales performance. It addresses “Are we properly following up on marketing leads and are those leads converting?” and “What does our sales feedback say about marketing campaign quality?”.

Example Insight: You might analyze all the leads generated from a particular marketing campaign (e.g., a whitepaper download) – say 200 leads – and see how many converted into opportunities and closed deals. If out of 200, only 5 became deals, you calculate the ROI of that campaign was poor, and sales feedback might reveal that many leads were not the right fit (perhaps marketing targeted too broadly).

Conversely, maybe your analysis shows that leads sourced via a webinar had an unusually high meeting booking rate, indicating that webinar content attracted very qualified prospects.

This can guide future marketing spend to what works. Another angle: account-based marketing (ABM) efforts – if marketing and sales targeted 50 named accounts together, you’d analyze progress on those specifically. Perhaps 30 of those engaged and 10 became customers – that’s a 20% account conversion, which might be great. If it’s lower than expected, you adjust the ABM strategy.

Additionally, analyzing sales data can reflect market reactions to different marketing mixes: for example, when marketing ran a promotional discount, did sales volume spike? If you have data on both, you can correlate marketing activities with sales outcomes (e.g., “analysis of sales data showed a 15% increase in outbound response rates during the week of our PR release – market reaction to our news helped outbound.”).

This type of analysis ensures sales and marketing alignment: it helps answer the crucial question of lead quality and follow-up – are marketing’s leads turning into revenue? If not, where’s the breakdown? It prevents the finger-pointing (“these leads suck” vs “sales isn’t working the leads”) by providing objective data.

For instance, if marketing leads have a much lower close rate than outbound-sourced leads, that’s a sign to refine the lead criteria or lead nurturing process (1). In summary, aligning these analyses makes the entire revenue engine more efficient.

Of course, there are other analyses like prescriptive analysis (using AI to suggest actions) and financial analysis (like cost of sale, profitability by client), but the above cover the core in evaluating outbound sales performance. The examples show how each type of sales analysis provides a different lens: one might highlight a team issue, another a product issue, another a process issue, and so on.

In practice, you’ll often incorporate several of these analyses into a comprehensive sales review. For instance, a quarterly business review might include a performance vs. target section, a pipeline metrics section, a product breakdown, and a win/loss summary. Each reveals insights that the others do not, and together you get a holistic view.

One more sales analysis example to tie it together: Suppose you conduct an end-of-year review. You use trend analysis to show sales grew 25% YoY (great!). You use segment analysis to show growth was driven mostly by fintech and healthcare clients, while manufacturing was flat.

- Product analysis shows your new AI-powered module sold very well (accounting for 40% of new sales).

- Funnel analysis reveals your lead-to-opportunity conversion improved after mid-year (when you changed your outreach messaging), but the proposal-to-close rate dipped slightly (perhaps due to more complex deals). Win/loss shows competitor X was active and beat you in a few deals on price.

- Marketing alignment analysis shows that leads from the big trade show converted at an amazing rate, contributing significantly to Q4.

With that mosaic of insights, you conclude: next year, invest more in fintech/healthcare targeting and the AI module, refine pricing strategy against competitor X (or better communicate value), give attention to boosting late-stage win rates (maybe more customer testimonials or ROI tools to push indecisive prospects), and double down on events like that trade show. This demonstrates how multiple types of analysis come together for strategic planning.

In short, sales analysis is a common method of evaluation because it offers these multi-faceted views easily (sales data is plentiful!), reflecting your target market’s reactions and your team’s execution (8). By leveraging different analysis types, you ensure you’re evaluating your outbound sales performance from every important angle – and setting yourself up to continually refine and succeed.

Best Practices for Sales Analytics in 2025

Personalized emails generate 40% more revenue for top-performing companies.

Reference Source: McKinsey & Company

Analyzing sales data is powerful, but to truly reap the benefits, you need to approach it the right way. Here are some sales analytics best practices to follow, based on what we see working for high-performing B2B organizations (and what we practice at Martal). Think of these as tips to ensure your sales analysis process is effective, efficient, and yields actionable insight – not just pretty charts that gather dust.

● Make Sales Analysis a Habit (Be Consistent): Don’t treat sales analysis as a rare audit or something you do only when things go wrong. The best teams have a cadence – e.g., weekly pipeline reviews, monthly performance analyses, quarterly deep-dives, etc. Regular analysis allows you to spot trends early and adjust in near real-time. It also normalizes data-driven decision making in your culture. For example, have a standard sales dashboard updated daily/weekly that everyone reviews.

Consistency also means using consistent definitions (e.g., what qualifies as an “SQL” or how you calculate “conversion”) so that analyses from different periods are comparable. Pro tip: Align analysis frequency with decision frequency – strategic pivots maybe quarterly, tactical tweaks weekly. And after any major campaign or initiative, do a quick analysis of its impact (don’t wait too long or you might miss the window to respond).

● Focus on Key Metrics: Sales data can be overwhelming. While it’s good to explore, always circle back to the handful of KPIs that matter most to your outbound success. Typically, these include metrics like pipeline generated, win rate, average deal size, sales cycle length, quota attainment, and outreach activity volume. Keep dashboards and reports centered on these, with other metrics as supporting detail. This avoids analysis paralysis. Remember that not all metrics are created equal – identify which are your north stars vs. secondary indicators.

For instance, pipeline coverage (pipeline vs quota) is a critical leading indicator for future sales (7). If that’s healthy, minor dips in call volume (a lower-level metric) might not be alarming.

Conversely, if pipeline is thin, you know immediately to boost prospecting. By focusing on a balanced set of both leading and lagging indicators, you ensure you’re proactive as well as reactive. McKinsey found that companies using both types of indicators to guide sales operations improved productivity by over 15% (7). So define your metric set, educate the team on them, and stick to them in reporting.

● Ensure Data Quality and Integrity: This might sound basic, but we can’t emphasize it enough – your analysis is only as good as your data. Invest in keeping your CRM data clean and up-to-date. That means training reps to log activities and update deal stages promptly (perhaps automating some of that logging to remove human error).

Set validation rules or use tools to prevent duplicates and enforce consistent formatting (like always having a value for industry or employee count on accounts). If you spot inaccuracies during analysis (like an obviously wrong close date or amount), correct them and consider why it happened – do you need a process tweak to avoid it recurring?

Many organizations also benefit from having a RevOps or sales operations person whose role is part data steward, ensuring the pipeline data is reliable.

Data governance might not be glamorous, but it pays off when everyone trusts the reports. If, for example, marketing and sales have different numbers for “total deals,” that’s a problem to fix at the source (unify definitions and data). One best practice is to have a single source of truth – typically the CRM – and integrate other systems into it so that you’re not juggling multiple spreadsheets from different departments. This way, when you do your analysis, you’re drawing from a coherent data set.

● Leverage the Right Tools: In 2025, there’s no shortage of analytics, BI, and lead generation tools that can make sales analysis faster and more insightful. From CRM’s built-in reporting to specialized sales analytics software and general BI platforms like Tableau or Power BI – use them!

A good tool will allow you to slice and dice data without manual labor, create visualizations on the fly, and even apply AI for anomaly detection or predictive modeling. For example, some CRMs can now automatically flag if your win rate is dropping significantly or if a particular industry is trending up. Utilize features like dashboards that update in real-time, so you always have a finger on the pulse. Additionally, sales engagement platforms often provide analytics on outreach (open rates, reply rates, etc.) – incorporate those into your sales analysis to connect activity to outcomes.

Another tool category is forecasting software that uses AI (some mentioned earlier) – these can supplement your own analyses and serve as a check/benchmark. The best practice here is: automate what can be automated. If every month you spend hours compiling data, invest once in setting up a report that updates itself. This frees you to focus on interpreting data and strategy.

Many companies now also enable data exploration for front-line managers – for instance, a VP of Sales might have an interactive dashboard to play with rather than waiting for an analyst’s static report. Empowering stakeholders with prospecting tools can improve buy-in and data-driven culture.

● Combine Quantitative and Qualitative Analysis: Numbers are crucial, but the story behind the numbers is equally so. Augment your quantitative sales analysis with qualitative insights. That might involve getting feedback from reps (“Prospects keep mentioning a new competitor on calls”) or listening to call recordings to contextualize a drop in conversion.

For example, your analysis might show a dip in win rate, but the why could be uncovered by reading a few lost-deal notes – maybe a competitor released a feature that you lack, or there’s a new common objection. Include these anecdotal or observational findings in your analysis reports. It gives color to the data and often suggests solutions more readily.

Qualitative insights could also come from customer surveys or interviews (if you have them from lost deals, etc.).

Essentially, data tells you what happened, but conversations often tell you why. The combination is powerful. When presenting to leadership, being able to say “Our close rate fell 5%, and reps report that many SMB prospects cite budget freezes as the reason” is more actionable than simply “close rate fell 5%.” It might lead the team to adjust targeting towards industries with budget or to arm reps with ROI calculators to overcome budget objections. So, don’t operate in a vacuum with just spreadsheets; talk to your salespeople and sometimes even customers as you analyze.

● Align Sales Analysis with Business Strategy: This is a higher-level best practice – always keep your analysis relevant to the overarching goals of the business. For instance, if the company’s strategy is to move upmarket and target enterprise clients, tailor your sales analysis to track progress on that (maybe include metrics like number of enterprise deals, average deal size trend). Don’t get lost in measuring something that isn’t strategically important. On the flip side, if cost of acquisition needs to drop for profitability, make sure your analysis covers efficiency metrics like cost per lead, deals per rep, etc.

Essentially, measure what matters to the business’s success, and communicate your findings in those terms. This helps secure executive support for your initiatives because you’re speaking their language (e.g., market share, growth, ROI). It also prevents the sales team from optimizing for a local maximum that’s not aligned with company objectives.

For example, if reps start maximizing number of deals at the expense of deal quality/size (maybe due to a comp structure), the analysis should catch that – maybe you see deal count up but average deal value down, which might hurt long-term revenue. Aligning with strategy might mean sometimes deprioritizing a metric in favor of another that better reflects the strategy’s success.

● Foster Collaboration Between Teams: Sales analysis often surfaces insights that concern other departments – like product, marketing, or customer success. A best practice is to share relevant findings and collaborate on solutions.

If your outbound team hears consistent product-related objections, loop in Product Management with that data so they can consider it in the roadmap. If certain marketing leads aren’t converting, work with Marketing to refine targeting criteria.

Sales and marketing analysis together (as we covered) can pinpoint misalignments – use those to hold joint teams accountable rather than placing blame. For example, if data shows marketing-sourced, business leads convert at 5% while outbound-sourced convert at 15%, figure it out together: perhaps marketing needs to target later-stage prospects or sales needs to follow up marketing leads faster; agree on an action, then track progress.

When Sales, Marketing, Product, etc., all see the sales analysis as a useful feedback mechanism (and not a gotcha exercise), the whole revenue engine improves. You might even consider cross-functional “win/loss” meetings where sales, marketing, and product folks discuss a couple of recent wins or losses with data on hand – very enlightening for everyone and builds a shared understanding.

● Keep the Customer in Mind: As you analyze sales data, remember that behind every number is a customer or prospect. Strive to derive insights that improve the customer’s journey. For instance, if your sales analysis finds that prospects are backing out late in the process (“analysis of sales data shows 30% drop-off at proposal stage”), think about the customer perspective: Are they getting enough info before proposal? Are their concerns addressed?

Best practices might involve adding a customer touchpoint, like a proposal review meeting focusing on their ROI, to ease them through. Another example: if the data shows faster closes when demo calls are done promptly after initial contact, that’s also a better customer experience (less waiting). So by all means, optimize internal processes, but frame it in terms of delivering value to customers faster and more efficiently.

In 2025, customer expectations are sky-high; they want quick, consultative, and personalized sales engagements. Your analytics can help deliver that – e.g., noticing that “customers engage more when we share a personalized insight in the first email” is a tweak that makes the experience better and lifts sales.

A customer-centric lens ensures your analysis doesn’t become too insular. In fact, many forward-thinking teams incorporate customer feedback data (like NPS scores or satisfaction survey results) into sales analysis to see how sales promises align with delivery. That could be beyond the scope of pure outbound analysis, but it’s useful if available.

● Document Insights and Share Knowledge: Each round of sales analysis is a learning opportunity. Don’t just keep the findings in a silo or only present them in one meeting. Document them in an accessible place – say, a Google Doc or an internal wiki – including what actions were decided.

This builds an institutional memory. New team members can review past analyses to get up to speed on what’s been tried and observed. It also allows you to track which changes led to improvements over time (since you can look back and see, for example, in Q2 we identified issue X and in Q3 fixed it and saw Y improvement).

Sharing knowledge extends to celebrating successes uncovered by analysis – if an SDR tried a new approach and the data shows it doubled their responses, share that story and data with the whole team (perhaps in a team meeting or Slack channel). It motivates and educates everyone.

Some organizations even produce a short “Sales Insights Monthly” report for internal use, summarizing key metrics and insights – that transparency keeps everyone aligned and engaged in improvement.

By following these best practices, you ensure that sales analysis is not just a periodic data dump but a powerful continuous improvement tool. In 2025, the companies that excel are those that treat data as a strategic asset – analyzing it rigorously and acting on it swiftly.

Conclusion: Data-Driven Sales for Outsized Outbound Success

As we’ve explored throughout this post, sales analysis in 2025 is both an art and a science – an art in how we interpret and act on insights, and a science in the rigorous use of AI and analytics to uncover those insights.

The main takeaways are clear: teams that harness their sales data and leverage AI-driven analytics are raising the bar on outbound sales performance. They’re finding the needle-in-haystack prospects faster, personalizing outreach at scale, and continually fine-tuning their approach based on what the numbers (and customers) tell them. In contrast, teams flying blind on gut instinct or outdated methods are falling behind in a market that’s moving quicker than ever.

To summarize the key trends: AI and automation have revolutionized outbound sales by automating grunt work and surfacing predictive insights – adoption of AI in sales has essentially doubled recently, and those embracing it are seeing tangible uplifts in revenue growth.

Data analytics has become the backbone of strategic sales decisions, from setting targets to reallocating resources; companies that actively analyze performance data are more productive and profitable.

Moreover, proper sales analysis is now a team sport – aligning sales with marketing and other functions to ensure every part of the funnel is optimized and the customer’s voice is heard. We also covered how to analyze sales performance step-by-step and the many angles (performance vs. target, sales and marketing funnel, product, segment, etc.) one can examine. The unifying theme is that a data-driven, analytical approach takes the guesswork out of outbound sales. It tells you what’s working, what isn’t, and points you toward the solution.

For sales leaders reading this: now is the time to double down on sales analytics and AI-powered selling. If you haven’t already, invest in the tools, training, and processes to make your sales org analytically savvy. The payoff is a more predictable pipeline, higher conversion rates, and ultimately more sales and revenue. It can be as straightforward as setting up a new dashboard, or as ambitious as integrating an AI platform – wherever you are on the journey, take the next step.

That’s where we can partner with you. At Martal Group, we specialize in data-driven, AI-enhanced outbound sales – it’s at the core of our Sales-as-a-Service model. When we say we offer “Sales Executives on Demand”, it’s not just human expertise we bring, but also a suite of AI-powered tools and analytical practices to supercharge prospecting and sales development.

Our global team (spanning North America, Europe, LATAM and beyond) uses real-time intent data and analytics to pinpoint high-potential prospects for our clients. We analyze market signals – almost like having our ear to the ground of your target market – so we engage the right leads at the right moment with the right message.

The result? Our clients see pipelines scale up quickly and efficiently. For example, leveraging our AI outreach platform and refined analytics, clients have ramped up sales pipeline 3× faster while reducing costs by up to 65% versus traditional methods. That’s the power of marrying human sales know-how with data and technology.

Our approach is consultative and transparent. We work closely with you, effectively acting as an extension of your team, and we share the insights we glean. If something in the campaign isn’t converting as expected, you’ll hear from us with the data and a plan to adjust.

If a particular message or channel is knocking it out of the park, we’ll double down on it. And because we operate with a flexible, fractional SDR model, you get the benefit of an advanced sales analytics operation without having to build it all in-house. We’ve spent over a decade honing this craft across 50+ industries, continuously updating our best practices as new data and tools emerge.

In practical terms, when you consider outsourcing inside sales with us, you’re not only getting skilled SDRs and sales execs – you’re getting a data-driven outbound engine. Our team sets you up with dashboards and regular reports, so you see exactly how your outbound program is performing (we love demystifying the numbers for our clients).

We benchmark and measure everything from email response rates to meeting hold rates to pipeline contribution, and we relate it back to your business goals. And because we pride ourselves on staying cutting-edge, you can trust that we’re using the latest AI and analytics techniques to keep you ahead of the curve. Your success is our success, so we are relentless in analyzing results and optimizing.